Retention demystified: understanding, calculating, and minimizing customer churn

It’s tough when buyers decide to part ways with your company. So how can you retain more of them? How can you increase customer lifetime value (CLV) across the board?

Understanding your company’s churn rate is a good place to start.

Whether you head product at a SaaS subscription business or lead sales and marketing at an enterprise software company, understanding the reasons behind churn can unlock new insights and increase your profit margins.

In this article, we’ll take an in-depth look at churn — what it is, why it’s important, how you can calculate it, and what you can do to reduce it.

What is churn?

Churn, also known as customer churn or attrition rate, is the percentage of buyers who stop using a company’s product or service over a period of time. Unaddressed churn can affect profit margins and hinder future growth.

So, what’s a “good” churn rate?

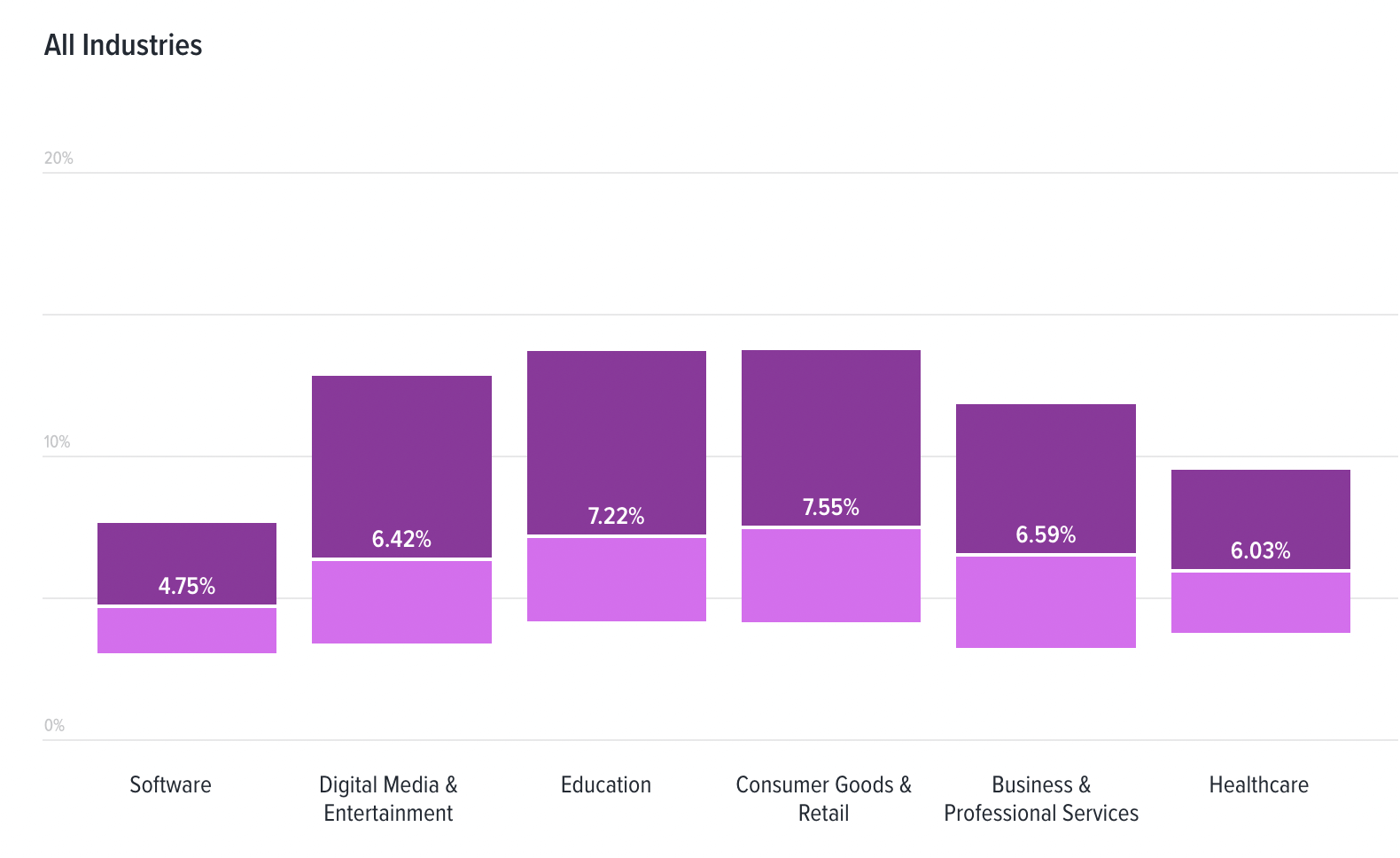

A good churn rate depends on your industry and company. The average subscription churn rate is 4.91% for B2B companies and 6.77% for B2C companies.

Certain industries have higher churn rates than others. For example, consumer goods and education tend to have a higher churn rate than software.

There are two types of churn:

- Voluntary churn: Ever canceled a subscription because you weren’t happy with the service? That’s an example of voluntary churn — when a buyer actively cancels a subscription.

- Involuntary churn: Involuntary churn occurs when a buyer churns because of issues like payment failures or server errors. In these instances, the buyer doesn’t choose to end their subscription.

We’ll look at different ways you can reduce churn later. For now, let’s discuss how you can calculate your churn rate.

How to calculate your customer churn rate (with examples)

Calculating your churn rate is fairly straightforward. But before you pull out your calculator, you’ll need three pieces of information:

- The period over which you want to measure your churn rate

- The number of buyers at the start of that period

- The number of buyers at the end of that period

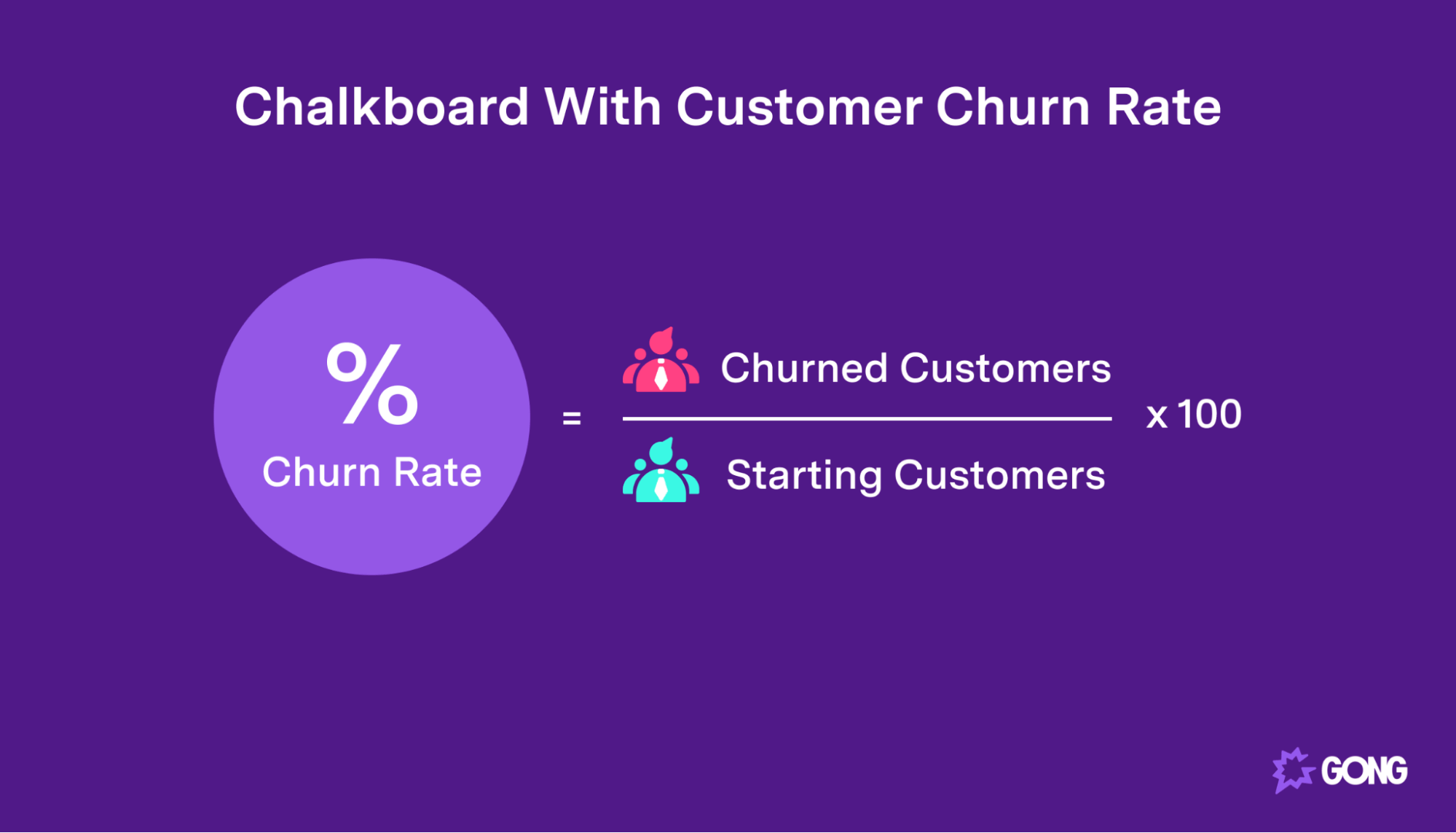

Divide the number of buyers you lost over a given period by the number of buyers you started with. Then, multiply the result by 100 to get a percentage.

Here’s what the churn rate formula looks like in visual form:

Let’s say you want to calculate your churn rate over four months. You had 1,000 buyers at the beginning of the month in January, but that number dwindled to 900 by the end of April (meaning 100 of your buyers churned).

Based on the figures above, your churn rate would be (100 / 1,000) x 100, or 10%.

The example above only looks at customer churn. To get a clearer picture of how churn affects your bottom line, there are two other types of churn you can calculate:

- Gross revenue churn rate or gross monthly recurring revenue (MRR) churn

- Net revenue churn rate or net MRR churn

Let’s take a closer look at both.

Gross MRR churn

Gross MRR churn is the percentage of monthly recurring revenue that your company loses from existing buyers due to product downgrades or cancellations.

Here’s the formula to calculate gross MRR churn:

- (Total MRR churn at the end of a period / Total MRR at the start of a period) x 100

Start by calculating your MRR. Multiply the number of monthly subscribers by the average revenue per user (ARPU). If you have 500 users and your ARPU is $150, your MRR is $75,000.

If your MRR for January is $75,000 and users cancel about $9,000 by downgrading to lower or free plans (or canceling altogether), your gross MRR is (9,000 / 75,000) x 100, or 12%.

Your gross MRR should be as low as possible. A high percentage could indicate that existing buyers aren’t deriving enough from higher-paid plans to justify their costs.

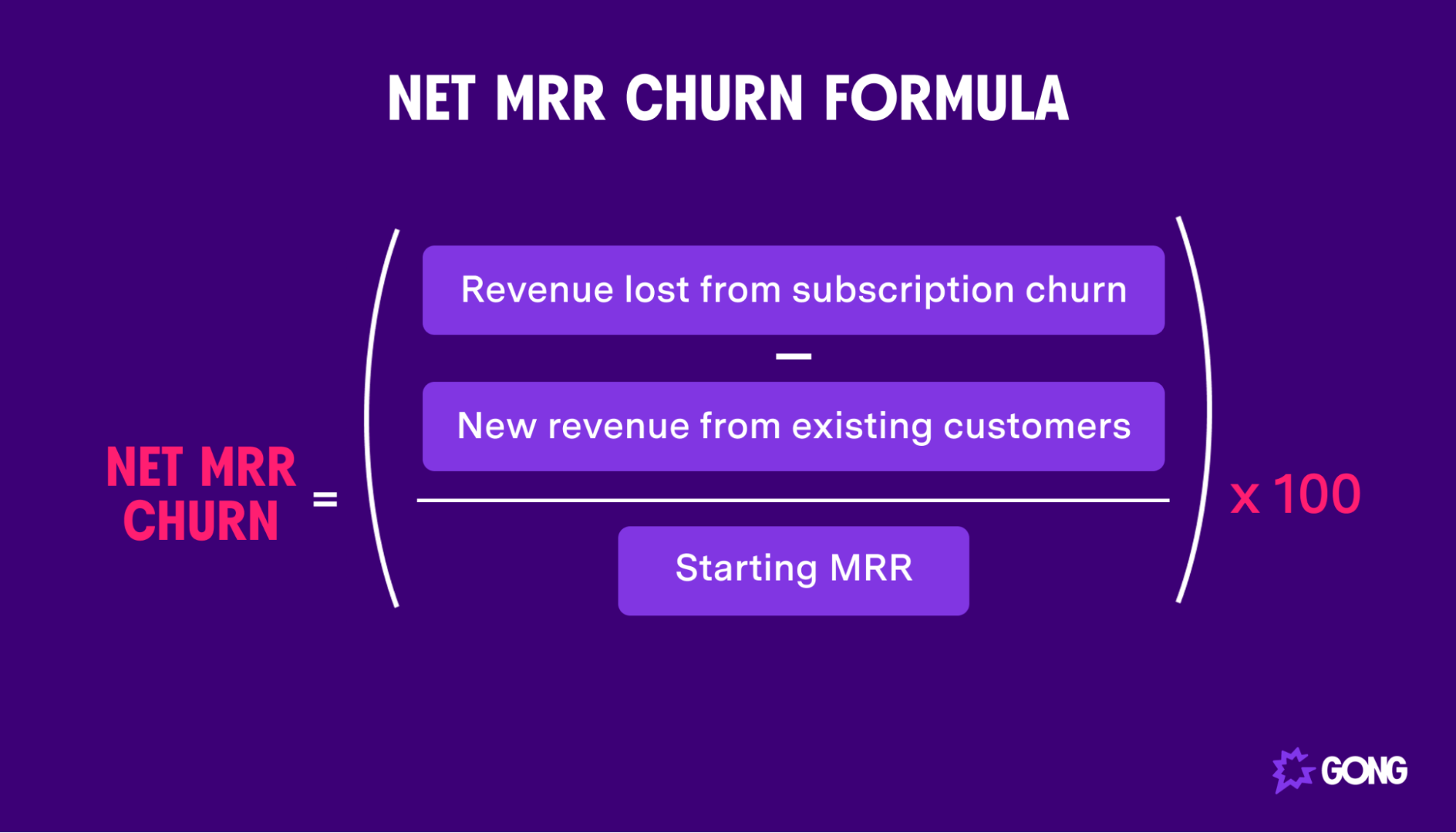

Net MRR churn

Net MRR churn is the percentage of lost revenue from downgrades and cancellations minus new revenue from existing buyers.

Here’s the formula to calculate net MRR churn:

- [(Revenue lost from subscription churn – New revenue from existing customers) / Starting MRR] x 100

Let’s say you have a starting MRR of $60,000, but you lost $5,000 due to cancellations and downgrades. However, a few of your buyers upgraded to a premium plan during that period, resulting in $3,000 in new revenue.

With these figures, your net MRR is [(5,000 – 3,000) / 60,000] x 100, or 3.3%.

This metric can help you determine how sustainable your business is. Unlike gross MRR, you want to aim for a negative net MRR churn rate — indicating that your revenue is increasing (and you’re still making a profit) despite buyers churning.

Why is it important to track and monitor churn?

You’ll never retain all of your buyers, but a high churn rate is problematic.

Here’s why every business should track this crucial metric:

It helps increase buyer retention

Finding new buyers is more expensive than retaining existing ones.

A high churn rate doesn’t just mean that you’re losing revenue; it also means your company will have to incur the cost of finding new buyers to make up for that lost revenue.

Your company won’t be sustainable if your buyers don’t stick around long enough to recover your customer acquisition costs (CACs).

Addressing the causes of churn can help you retain existing buyers and boost your bottom line — without spending more on acquisition.

It helps you uncover valuable insights

A high churn rate tells you that something is amiss.

Did someone have a poor onboarding experience? Or are buyers not deriving value from your products or services? A churn analysis can help you find the answer.

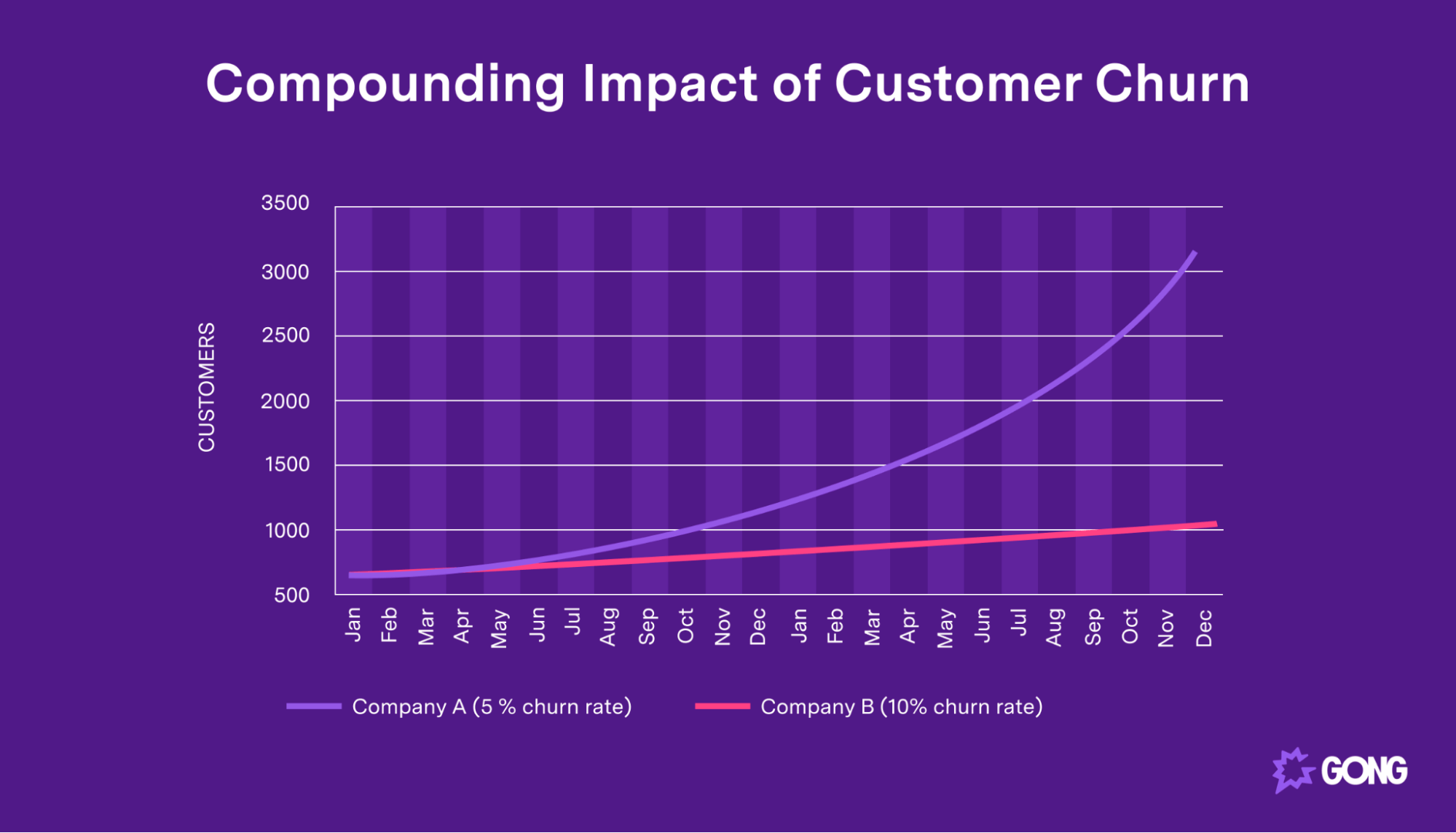

It helps you grow your profit margins

Churn cuts into your profit margins, so taking steps to reduce it has huge implications for future revenue.

To illustrate, let’s say two companies acquire buyers at a 15% rate. However, Company A has a 5% churn rate, and Company B has a 10% churn rate. All other factors being equal, Company A will outgrow Company B by over 500% within two years.

This graph paints a compelling reason to start tracking and monitoring your churn rates (if you aren’t already).

What causes customer churn?

The first step to combating churn is to understand why buyers leave.

Here are a few common reasons behind churn:

Your onboarding process is falling short of expectations

User onboarding is one of the most important parts of the buyer journey. It introduces new buyers to your products or services and helps them achieve desired outcomes.

However, companies aren’t doing enough to onboard their users. 90% of buyers feel that companies “could do better” regarding the onboarding experience. Poor onboarding can cause your buyers to churn.

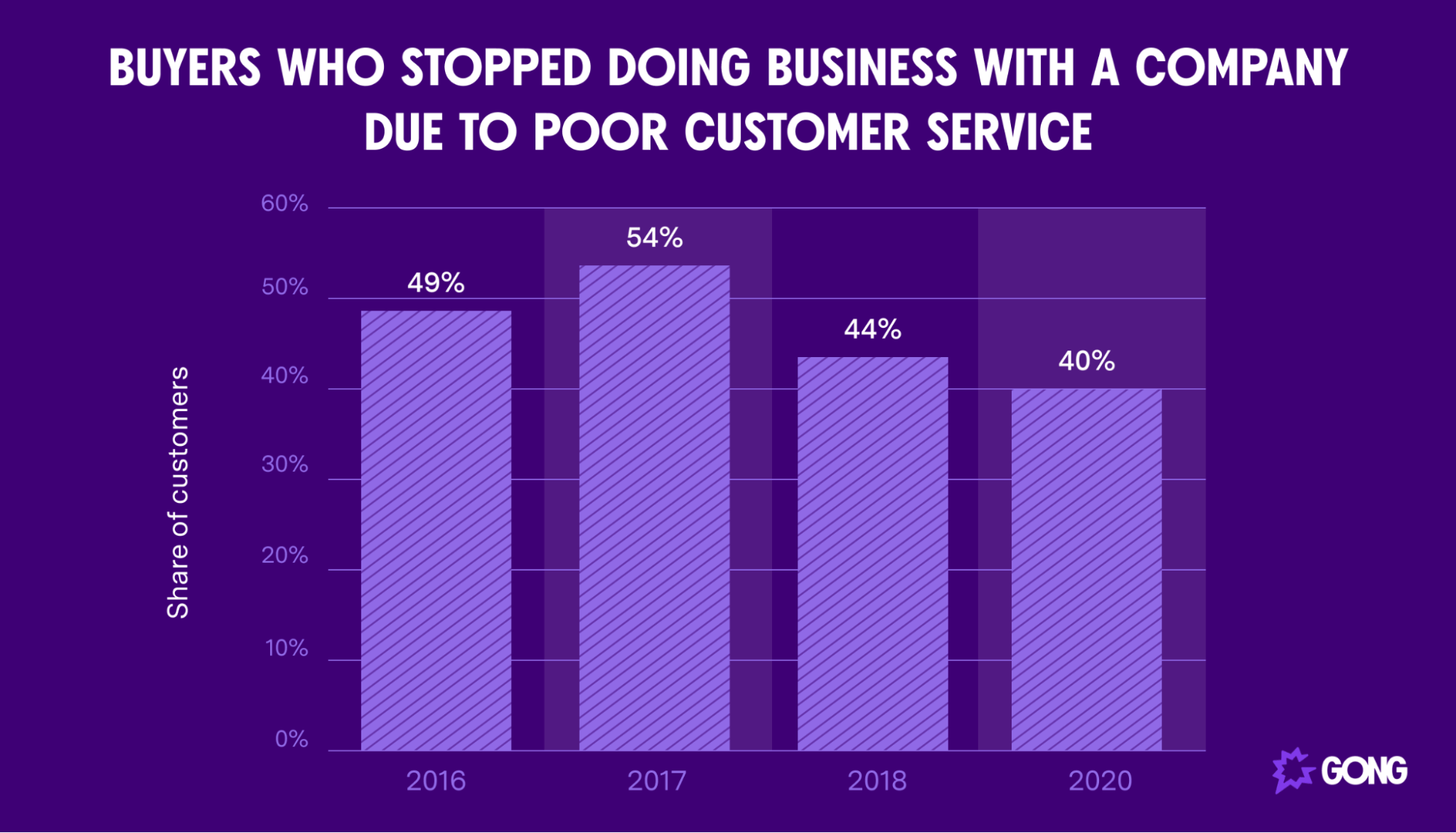

Your buyers have experienced poor customer service

When buyers cannot resolve their issues, they become dissatisfied and churn. 40% of US buyers have stopped doing business with a company due to poor customer service.

Today’s buyers have higher expectations than ever. Companies that fail to meet these expectations risk losing their best customers.

Your buyers can no longer justify the expense

If buyers aren’t experiencing the full value of a product, even a small price increase can push them to seek an alternative.

One Netflix user canceled their subscription because of a price increase:

Now that we’ve covered the customer churn meaning in business, let’s look at how you can reduce your churn rate and retain more buyers.

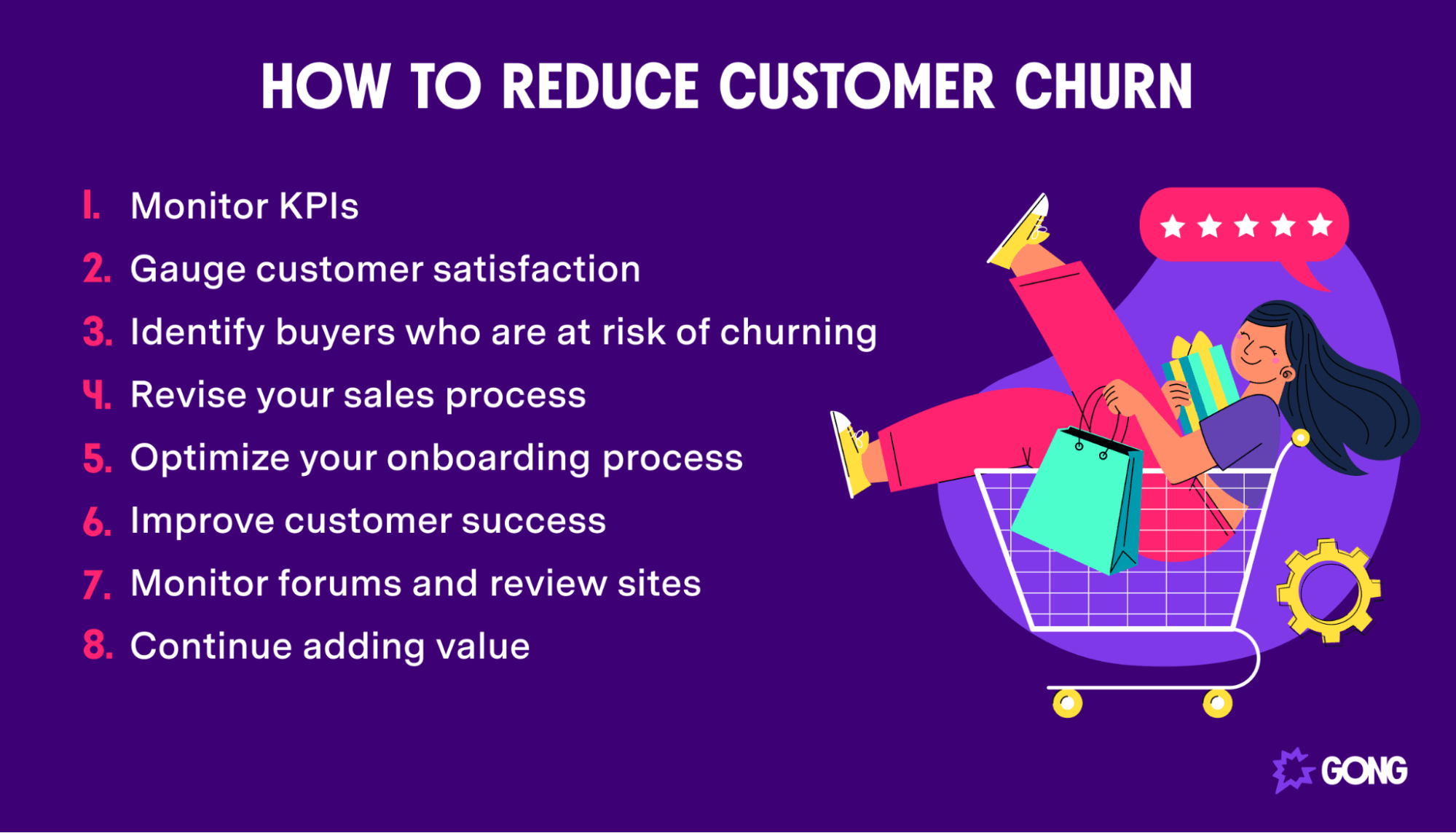

How to reduce your churn rate

While you should aim to keep your churn rate as low as possible, some degree of attrition is inevitable. The good news is there are practical steps you can take to reduce your churn.

Let’s dive in.

1. Monitor KPIs

Once you calculate your churn rate, you’ll want to monitor key performance indicators (KPIs), like activation rates during the churn period. This will enable you to establish benchmarks and even identify at-risk buyers.

Here are the KPIs you should monitor:

- Activation rate: The activation rate is the percentage of users who complete a milestone in your onboarding process. That milestone depends on your “aha” moment — when users first realize the value of your product.

- DAU/MAU rates: Daily active users (DAUs) to monthly active users (MAUs) measure how “sticky” your product is. A high ratio means that your users are highly engaged and less likely to churn. Simply divide your DAU by your MAU to calculate this metric.

- Net promoter score (NPS): NPS surveys ask buyers to rate their likelihood on a scale of 0 to 10 to recommend your business to a friend or family member. They help you assess buyer satisfaction.

- Expansion MRR: Expansion MRR is your company’s additional revenue from existing buyers through upsells or add-ons. It’s an indicator of buyer loyalty.

Monitoring these metrics can help you determine why buyers churn. For example, a low activation rate tells you that your onboarding process could use some work.

2. Gauge buyer satisfaction

Don’t underestimate the voice of the customer, as it allows you to gain qualitative feedback directly from your users and makes them feel heard.

One way to get feedback is to send out customer surveys. Start by sending surveys to your most engaged users.

Here are some questions you can ask:

- “How satisfied are you with our products or services?”

- “How can we improve your experience with our company?”

- “How can we help support your company’s goals?”

Conduct one-on-one interviews if possible, as this will allow you to ask follow-up questions. Analyze buyers’ responses and look for any recurring issues. If multiple users cite product-related issues, work with your development team to address the issue to prevent buyers from churning.

3. Identify buyers who are at risk of churning

There are often certain indicators that users are about to churn. Examples include decreased product engagement and increased negative sentiment on calls.

One way to identify at-risk buyers is to use sales intelligence software like Gong. You can use trackers to set up alerts for certain words or phrases in calls and emails. This can help your customer success team identify account risk by triggering alerts for phrases like:

- “We’re not seeing strong adoption of [solution].”

- “The team isn’t using [solution] as much as we thought.”

- “We’re also considering [name of a competitor].”

If a buyer says they’re not seeing strong results, your customer success team can take proactive measures to keep the account from churning.

4. Revise your sales process

Poor product fit is a common reason behind churn. If your reps sell to unqualified prospects, they’ll likely churn once they realize they can’t achieve their goals with your solution.

If you’re experiencing high churn rates, narrow the sales qualification process. This will ensure your reps focus on the right prospects instead of simply chasing commissions.

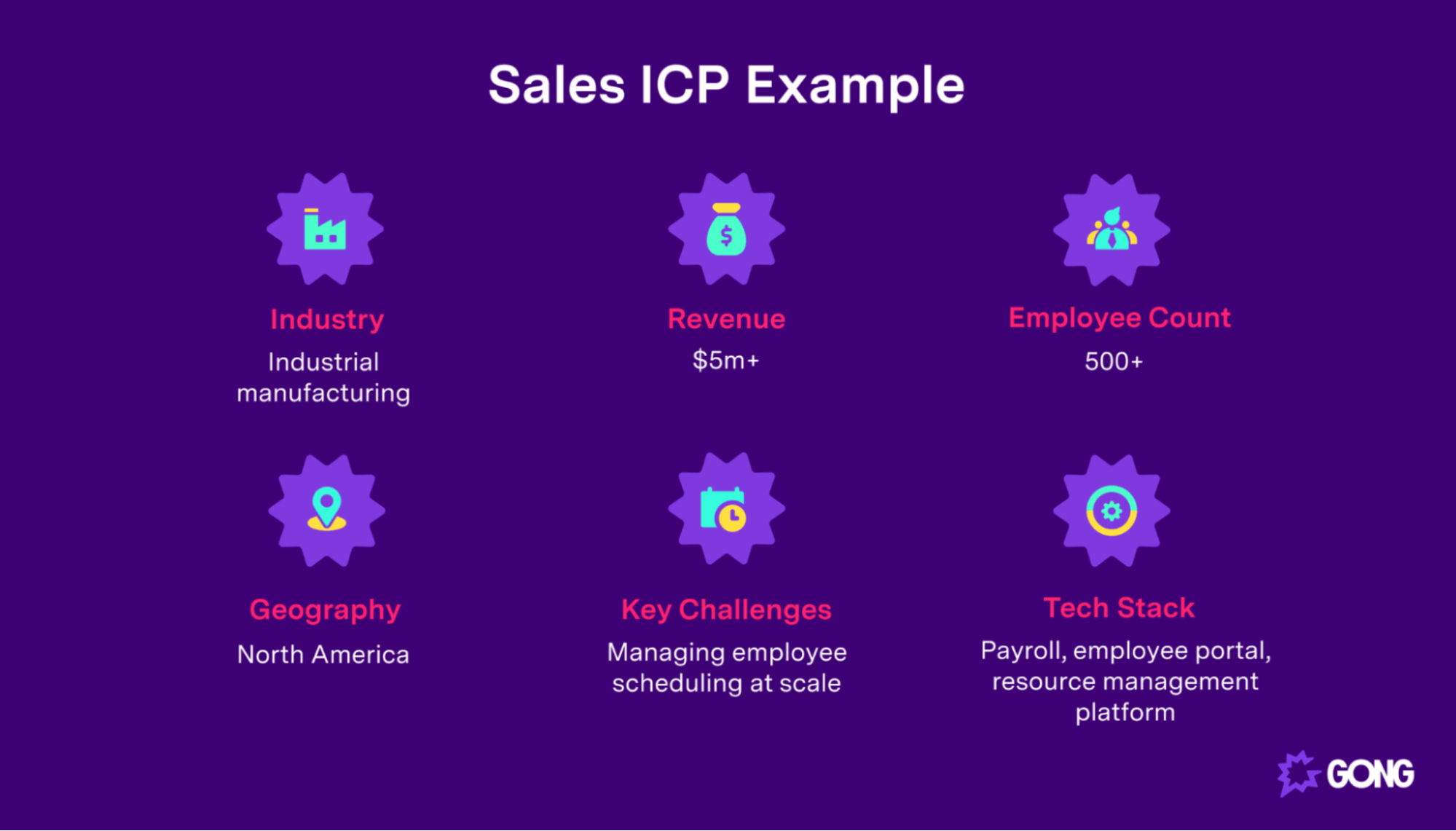

Start by creating an ideal customer profile (ICP) — a description of the type of company that would benefit from your products or services. Pull data from your sales CRM and look for common attributes among your most engaged buyers.

Here’s an example of an ICP:

Just handing your reps an ICP won’t be enough, though. Be sure to evaluate and revise your sales process to align with your target buyers.

Finally, make sure reps are confident that your products or services can help buyers reach their goals. This will help ensure product fit.

5. Optimize your onboarding process

Getting started with a new product or service isn’t easy. If you don’t help your buyers experience the value of your solution, they’ll be more likely to churn.

Ease the transition with an effective onboarding process. This will help guide your buyers to their first “aha” moment and increase their engagement rates.

You can improve the user onboarding process by:

- Sending a welcome email to new users

- Personalizing the onboarding journey

- Creating a helpful empty state

- Including interactive product tours

- Adding checklists or progress bars

- Sending follow-up emails with helpful tips

Click here for more user onboarding best practices.

6. Improve customer success

Customer success is another area to prioritize if you want to reduce churn. It involves taking a proactive approach to helping buyers achieve desired outcomes.

Why is this important?

Because when you help your buyers succeed, they’ll be more likely to continue using your product. This is essential for growing revenue, especially for a subscription business.

Identify your most engaged buyers and assign dedicated customer success managers to those accounts to get started. They will nurture buyer relationships and ensure buyers get fast time-to-value.

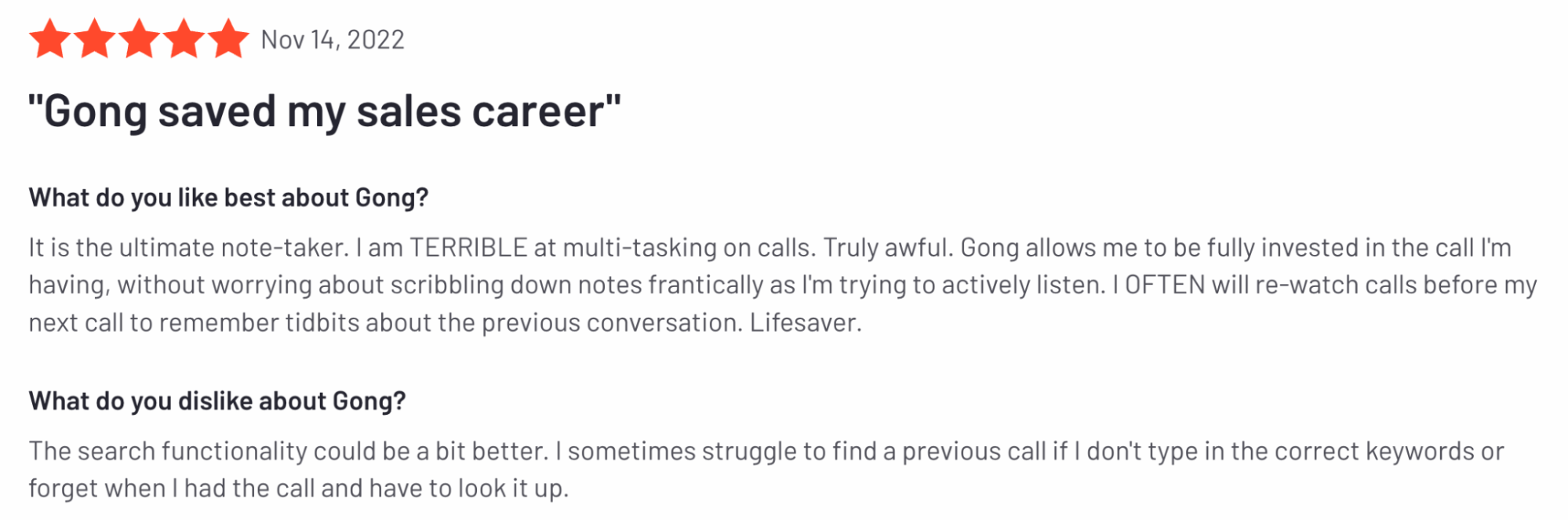

7. Monitor forums and review sites

Some buyers may voice their opinions on forums or review sites like G2. These are great sources of feedback that tell you what your buyers like (and dislike) about your product.

For example, here’s some feedback that one user left on G2 about Gong:

This buyer loves that they can use Gong to focus on their calls instead of having to take notes. However, they noted that the search functionality could be a little better (something we can take to our development team).

Monitor what your users say, and note any recurring issues. Some sites, like G2, even let you respond to your buyers, allowing you to help them resolve any issues before they churn.

8. Continue adding value

Ultimately, your buyers only want what’s best for them. If a competitor offers more compelling features, many won’t hesitate to switch over.

Here’s why one development company switched to Asana from Unfuddle Stack:

After many years of using Unfuddle Stack as our business task tracking system, we felt dissatisfied. The lack of a calendar-based view and an inflexible search made it challenging to organize team tasks and get a holistic view of any worker’s schedule.

If your competitors offer compelling features at a fair price, don’t be surprised if your buyers start churning. Unfuddle Stack lost a valuable buyer because it lacked key features its competitors offered.

Find ways to add value to your products or services continually. Examples include adding new features and improving existing ones. Then, clearly communicate those changes to your users so they can take full advantage of them.

Trust Gong for customer retention

Calculating and analyzing customer churn isn’t exactly pleasant. But it can help you pinpoint gaps in your customer retention strategy. Implementing some of the strategies outlined here can help you fill those gaps and increase retention.

Of course, one of the best ways to reduce churn is to address it before it happens. Gong’s customer retention management software can help your customer success team identify which accounts are at risk of churning so they can take proactive measures to get ahead of it.

Request a demo today to see how Gong can help you reduce customer churn and improve retention rates.

- What is churn?

- How to calculate your customer churn rate (with examples)

- Gross MRR churn

- Net MRR churn

- Why is it important to track and monitor churn?

- It helps increase buyer retention

- It helps you uncover valuable insights

- It helps you grow your profit margins

- What causes customer churn?

- Your onboarding process is falling short of expectations

- Your buyers have experienced poor customer service

- Your buyers can no longer justify the expense

- How to reduce your churn rate

- 1. Monitor KPIs

- 2. Gauge buyer satisfaction

- 3. Identify buyers who are at risk of churning

- 4. Revise your sales process

- 5. Optimize your onboarding process

- 6. Improve customer success

- 7. Monitor forums and review sites

- 8. Continue adding value

- Trust Gong for customer retention