Competitive Advantage in Today’s Market Comes Down to This “Low Tech” Factor

Selling Skills

In Michael Porter’s seminal book Competitive Advantage, he highlights three core competitive strategies:

- Cost leadership

- Focus

- Differentiation

Product Differentiation Isn’t Enough for Competitive Advantage

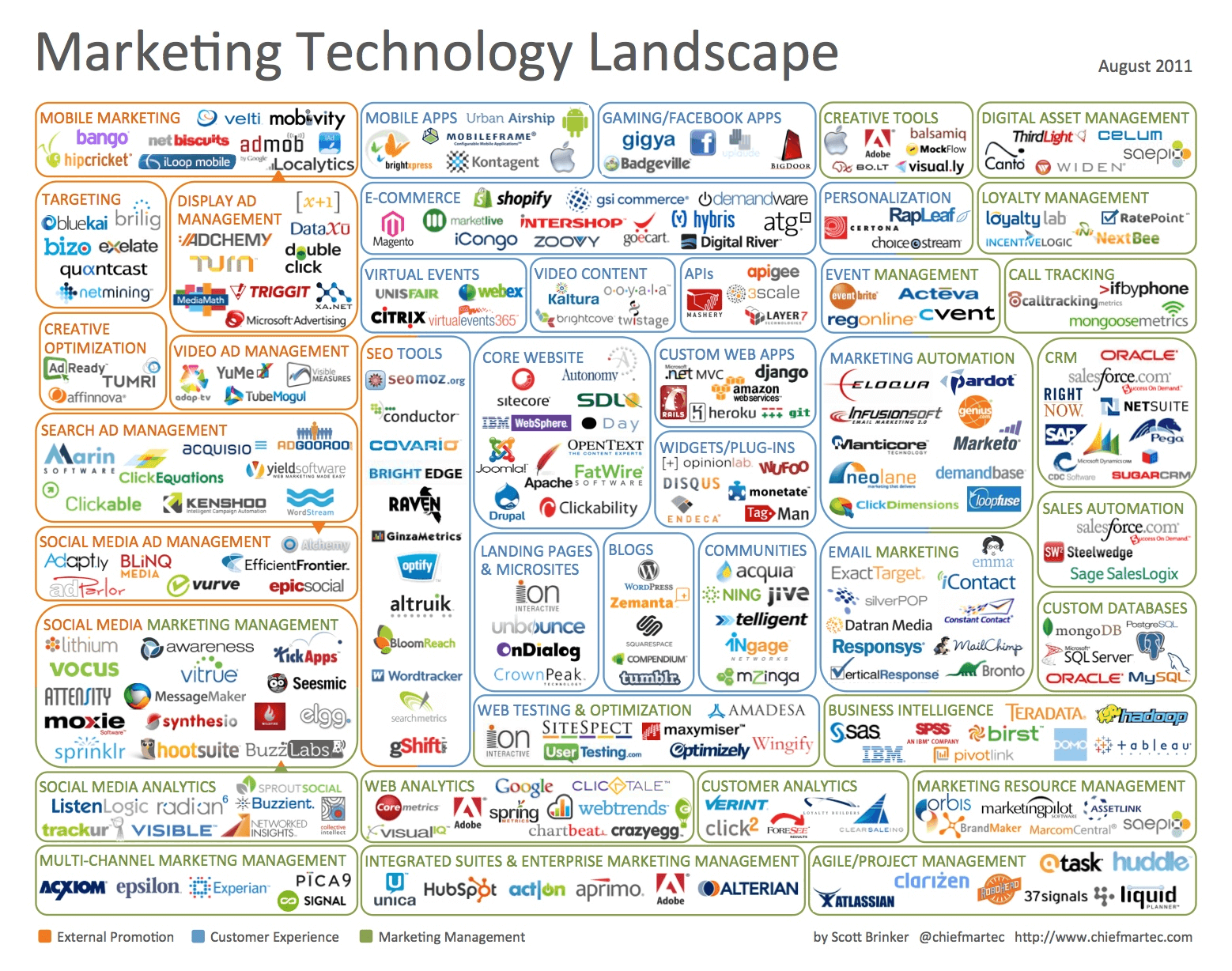

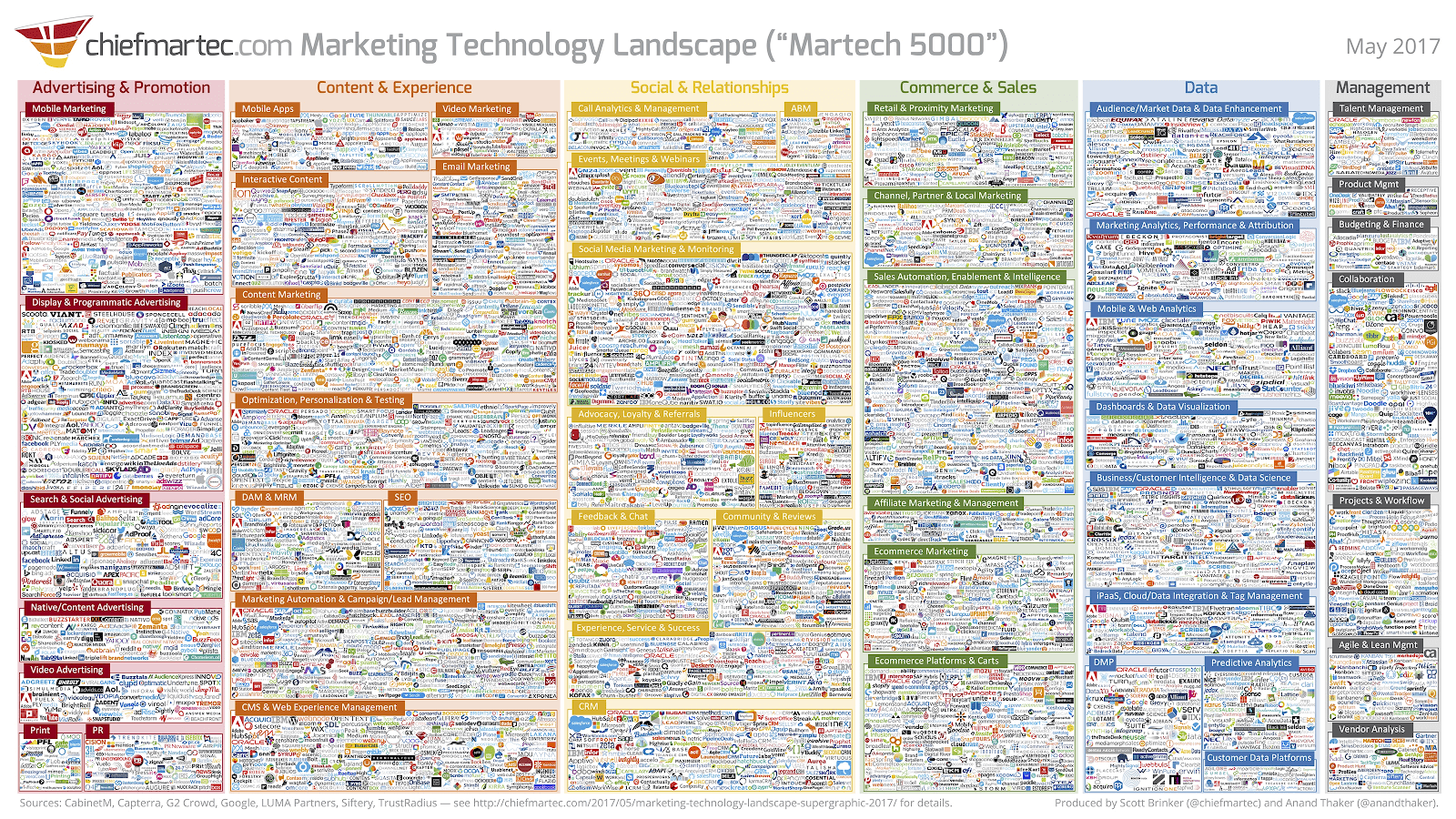

When most people think of differentiation, they think in terms of their product. But as Porter points out, differentiation can be sourced from any part of your “value chain.” Not just your product. And here’s why that insight is more important than ever: If you rely on your product to differentiate in today’s world, you’ll get creamed. Today, sales conversations — what your sellers say, do, and write — are where the perception of difference is created. In other words:The battleground for competitive differentiation has shifted from product, to sales conversations.How can I say this? Simple. Almost every B2B category is exploding with a swath of competitive products. Here’s just one example: the marketing technology industry. In 2011, this industry had 150 vendors. That’s already a lot of noise. But it’s gotten exponentially worse. Today, Martech has over 5,000 vendors (That’s not a typo). Product differences are unlikely to cut through this clutter. This is just one example. The same explosion in competition is happening in (almost) every B2B category.

Customers Won’t Evaluate You In a Vacuum

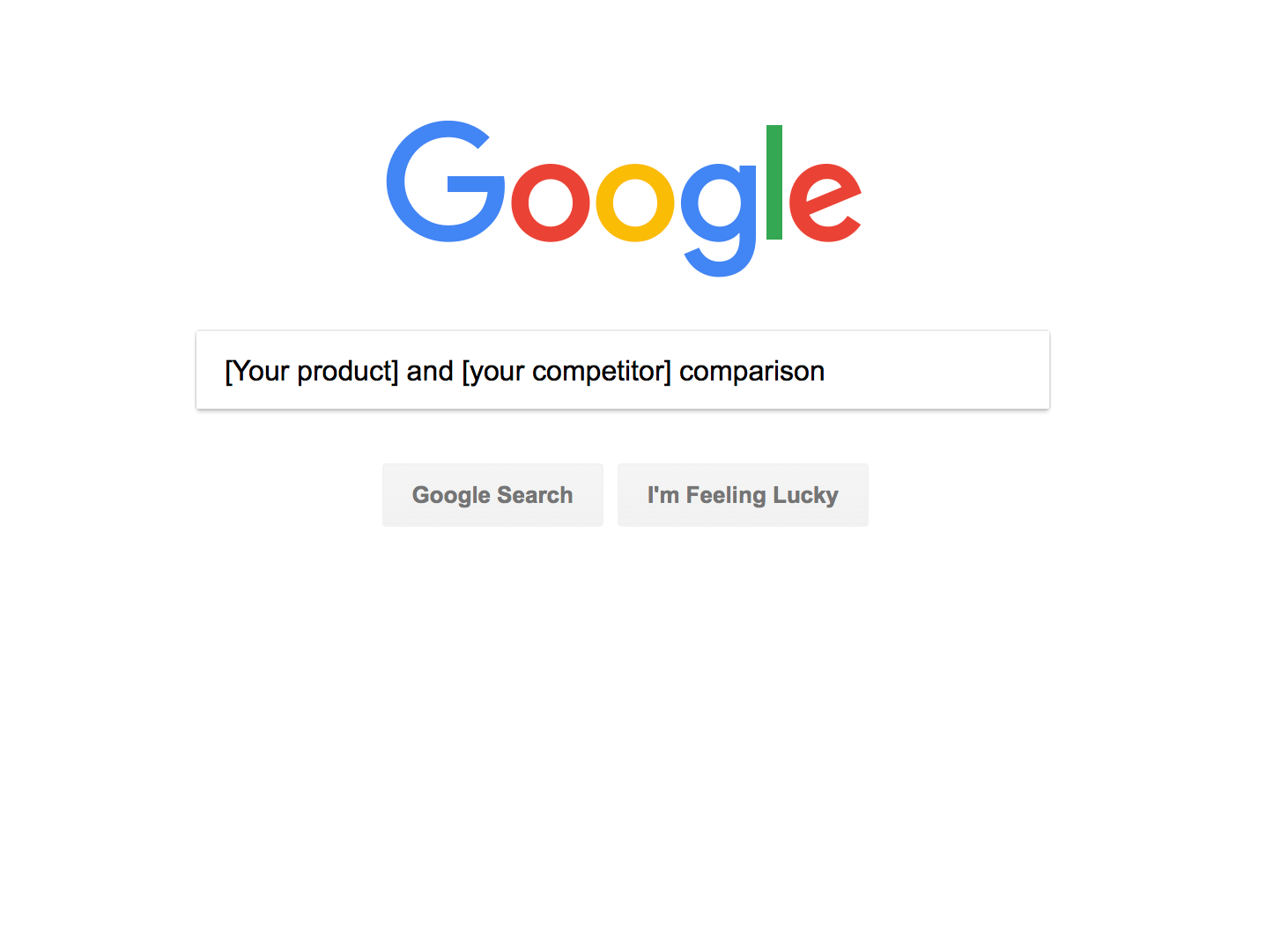

If all of this wasn’t difficult enough, your customers are actively throwing themselves into this sea of choices. Today, when customers evaluate products, they actively search for alternatives to compare it to. “Comparison searches” on Google have grown by 5-10x (depending on the category) since 2011. These two trends, when combined, lead to what I call the “Twin Effect.”The “Twin Effect”

Telling the difference between two competing products is like telling the difference between twin children. To you (the parent), the differences are obvious. You eat, sleep, and breathe your product. You probably visit your competitor’s website regularly, too. You can immediately tell the difference between your product and your competitors’. It’s not so easy for your buyers. They don’t spend all day with your product. Since it’s their first time comparing the two products, they look the same to the untrained eye. This leads back to my opening point. Sales conversations are the new vehicle for differentiation. Rather than relying on your product for differentiation, it’s nothing more than a ticket to play the game. Important? Yes. But it’s insufficient without effective sales calls, meetings, and email communications.Have You Ever Been Here Before?

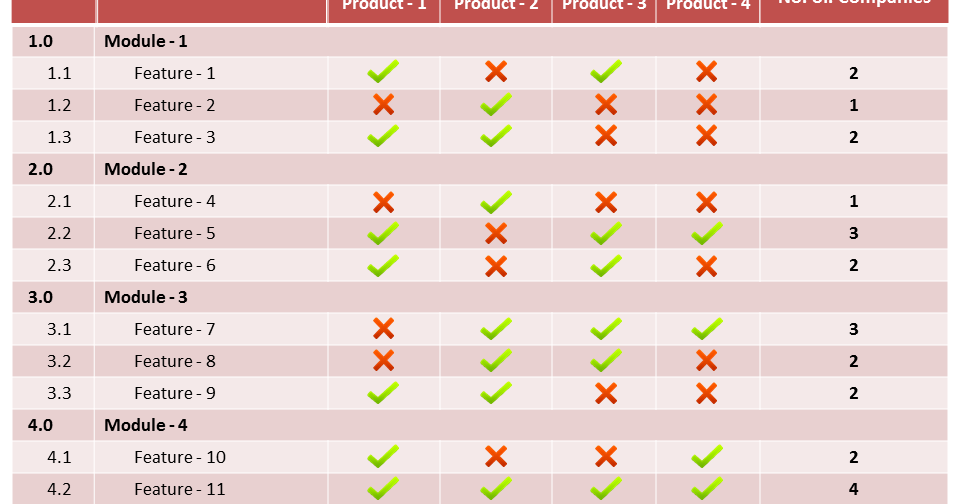

Here’s how relying on your product for differentiation plays out in the trenches. After your buyer watches dazzling product demos from both you and your competitors, they start feeling a keen desire to understand the differences. So, in an effort to “make an intelligent business decision,” they create the dreadedcomparison spreadsheet. It usually looks something like this: The use of this comparison tool leads to a fierce competitive “bakeoff,” and triggers what I call the “spec war.” You “one-up” your competitor with Feature A. They retaliate, match Feature A, and one-up you on Feature B. This cycle continues until your customer concludes:“These products are at parity with each other.”They resort to doing what you were trying to avoid all this time. They grind you both down on price. You offer a 10% discount. Your competitor offers 15%. And so it goes. When the screen fades to black, the “winner” of this story is the company who erodes the integrity of their pricing. The common complaint from the losing seller typically sounds like this:

“The customer said he’s never seen two products look more identical , and the decision came down to price. He just didn’t ‘get it’.”