Strategies to calculate and improve net dollar retention

Chances are, you’ve heard of net dollar retention but are unsure how to utilize it for customer success.

Let’s clear things up.

Net dollar retention (NDR) is a crucial metric for SaaS companies. Calculating it can help marketers and sales reps forecast customer lifetime value (LTV) and make decisions that better align with the buyers’ long-term needs.

But customer success teams also need to pay close attention to this metric, because their work can directly influence it.

This article will help you understand dollar retention, its value and meaning, and how it is measured. We will also give you an easy net retention formula to follow.

What is net dollar retention?

Net dollar retention is a key performance indicator businesses use to measure customer loyalty, growth, and profitability. This metric helps you understand how much revenue your business keeps compared with the amount lost due to churn or cancellation rate.

If you earn $100 from a buyer cohort today, how much will you earn from them in a month? In a year? Think of NDR as a measure of how successful your business is at keeping its buyers and incentivizing them to spend more.

You may have also heard the term net revenue retention, which has the same meaning. NDR is measured in percentages and is usually calculated monthly, although yearly calculations can also be helpful when you need to focus on the long-term dynamics.

Net dollar retention can and should exceed 100%.

Gross dollar retention, or gross retention rate, is a similar metric, although slightly less insightful. It shows the amount of revenue that you keep from your existing buyers but without including upgrades.

Unlike NDR, gross dollar retention can’t exceed 100%.

Why you should monitor your net dollar retention rate

Net dollar retention rate is one of the most crucial performance metrics for SaaS companies. It indicates if a company’s product or service is meeting buyer needs effectively enough to get them to renew after their initial subscription expires.

Companies with high NDR rates have many satisfied repeat buyers, while those with low NDR rates rely on the constant stream of new subscribers but rarely see renewals.

That’s why you can’t tell how a business is doing by looking at its monthly recurring revenue alone — you need to know how much of that money the company actually retains.

Businesses with a high net dollar retention rate are considered highly successful because they have loyal buyers who keep coming back for their products and services. Conversely, businesses with low NDR struggle to keep their buyers interested and engaged.

Here’s why monitoring NDR is a must for any growing and established SaaS company:

- Predict future revenues more accurately. Metrics like monthly recurring revenue (MRR) can be misleading — tracking your NDR rate can help you get a more realistic picture of how your business is doing.

- Ensure your product meets your customers’ needs. NDR doesn’t exist in isolation. This metric reflects how satisfied and loyal your buyers are, which is key to sustainable long-term growth.

- Track shifts in subscription plan preference, price points, and more. A low NDR rate isn’t a disaster but rather a timely warning to help understand how to make your offer more relevant, usable, and valuable to your target audience.

- Rethink and improve your customer retention strategy before things go south. Is your NDR rate lower than expected? Then it’s time to adjust to the changing buyer preferences. Does it exceed the average rate? Then, you’re on the right track.

Keep in mind, a healthy net dollar retention rate enables you to reduce customer acquisition costs (CAC). This is important because acquiring new users requires more resources than retaining existing ones.

Yearly customer churn costs US companies $168 billion per year. Of that amount, $35.3 billion of that money could’ve been recovered by keeping buyers happy.

Hefty CACs will be less of a problem if your retention rates are high. Engaged buyers, whose loyalty only grows over time, will enable you to focus on the product itself instead of pouring all your resources into acquisition. They’ll be the ones doing word-of-mouth marketing for you.

Let’s sum it up.

Knowing your net dollar retention gives you a better understanding of your customer base and their habits and needs. You’ll be able to serve them tailored products and services that give them the best value for their dollar.

Ultimately, tracking NDR helps flag problems early on, so you can take proactive steps to reduce churn and unlock longer-term profitability.

How to calculate net dollar retention (NDR)?

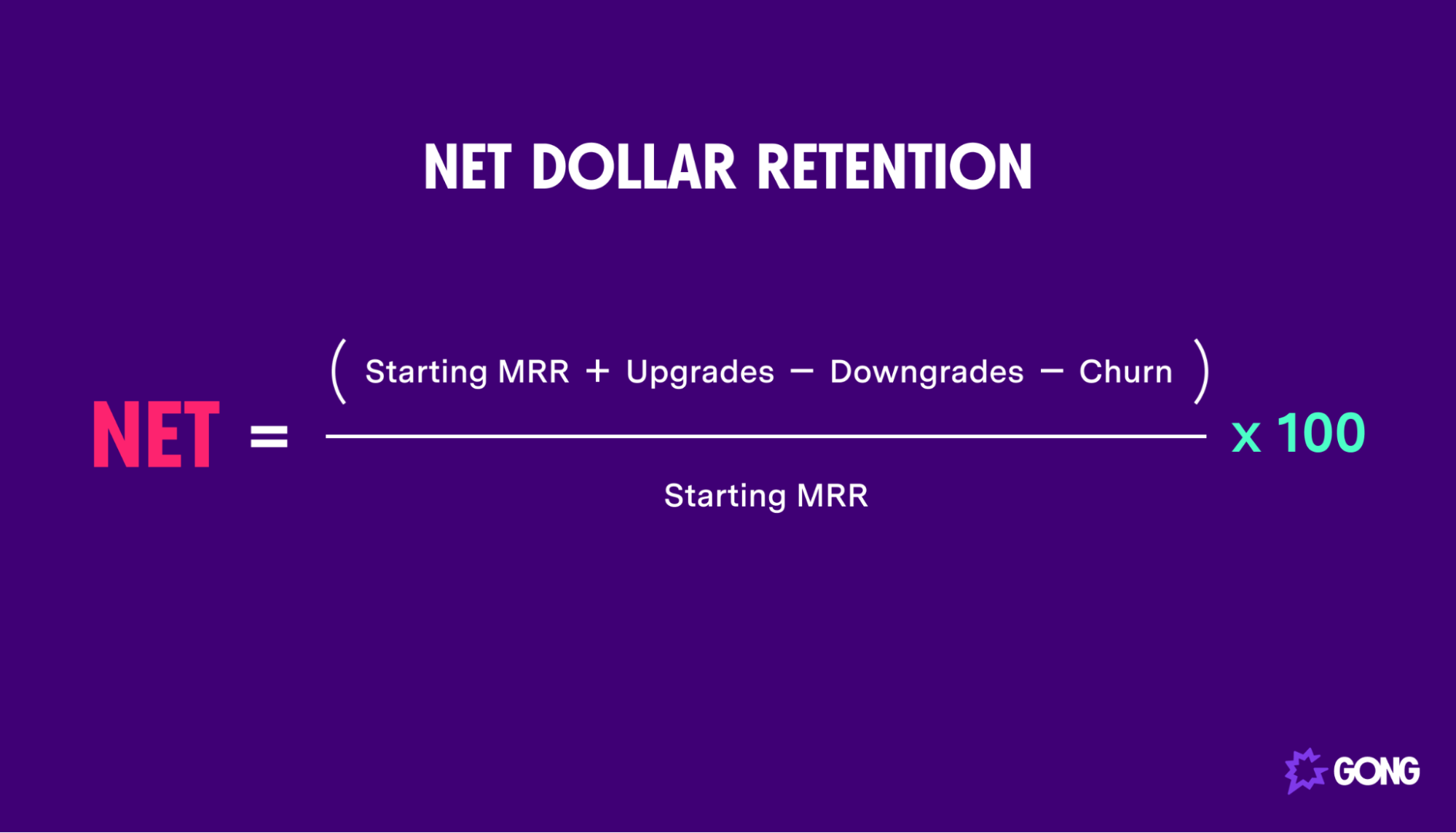

To calculate your net dollar retention (NDR) for a set period, you’ll need your monthly recurring revenue, upgrade MRR, downgrade MRR, and churn MRR data over the course of said period.

- Upgrade MRR is the monthly recurring revenue generated by customers opting for a more expensive plan.

- Downgrade MRR is the monthly recurring revenue lost due to customers moving to a cheaper plan.

- Churn MRR is the monthly recurring revenue lost due to cancellations.

You can rely on this net dollar retention formula:

Let’s say, your company starts the month with $450,000 in monthly recurring revenue.

During that month, some of your loyal customers enjoy your product so much that they decide to upgrade to a premium plan, bringing you $70,000 in additional revenue. However, other users downgrade to a cheaper plan or stop using your product altogether, costing you $50,000.

Based on the data above, your NDR rate would be 104%:

- [ (450,000 + 70,000 – 50,000 ) / 450,000 ] x 100 = 104%

A high resulting percentage indicates the health of your business. It means that existing buyers continue to purchase additional products or features from you during their lifecycle. The more money retained from existing customers, the better.

Net dollar retention rates of over 140+% signify that your retention strategy works smoothly and you can safely increase your customer acquisition spending — you know your efforts will pay off generously.

What’s a good net dollar retention rate?

A good net dollar retention rate will vary depending on your industry and type of business. Generally speaking, anything above 100% is considered reasonably healthy, with anything over 120% being excellent.

If your NDR drops below 90%, it might be cause for concern.

Any numbers below 80% should be further investigated as there may be issues with customer retention or upselling strategies. It makes sense to maintain your NDR at least near or above 100% to ensure long-term financial stability and growth opportunities.

According to Dave Kellogg, a tech advisor and angel investor, the median net dollar retention for enterprise software startups is 104%. In his opinion, for early-stage SaaS companies, the benchmark should be set at 90% or higher. Companies that go public typically have net dollar retention rates of well over 110%.

Kellogg also notes that organizations must deliver impeccable customer experiences to maintain a good net dollar retention rate.

How to improve your net dollar retention rate

Ultimately, this metric serves as an indicator of customer satisfaction.

NDR enables you to understand what needs improvement before your frustrated buyers abandon you for a competitor’s product.

Follow these 5 steps to improve your net dollar retention rate.

1. Improve your customer retention rate

Attracting new buyers is important. However, the focus should be on retaining existing buyers because it’s less expensive.

Gaining the trust of your buyers will make them more likely to purchase additional products and services, resulting in higher levels of loyalty and boosting your NDR rate.

Reducing downgrades and churn can help you unlock growth and get a more dedicated audience truly passionate about your product.

Achieve this by:

- Setting clear expectations

- Providing guidance to help your buyers reach their goals

- Empowering your buyers with high-quality tools and resources

- Tracking buyer interactions and inquiries

- Creating a detailed customer experience roadmap

- Collecting feedback through surveys and one-on-one conversations

- Tracking user behavior to understand their journey and challenges

- Creating one source of truth for your entire customer success team

- Rewarding your loyal users

Educational newsletters, helpful prompts, smooth onboarding, step-by-step walkthroughs, video tutorials, checklists, and kickoff calls — there are limitless ways to help your buyers make the most out of your product.

2. Provide state-of-the-art customer service

Customer service plays an integral role when it comes to retention rates.

Developing good relationships with your buyers starts at the initial contact point and continues throughout their journey. Anticipate buyer’s needs and be attentive to what they have to say about the product. Once you’ve provided them with a solution, make sure to regularly follow up with them to get feedback and see where you can help.

3. Revamp your upselling strategy

Upselling is an effective marketing tactic for increasing revenue from existing buyers. However, they may need a little nudge to open their wallets, and that’s where SaaS companies often get creative.

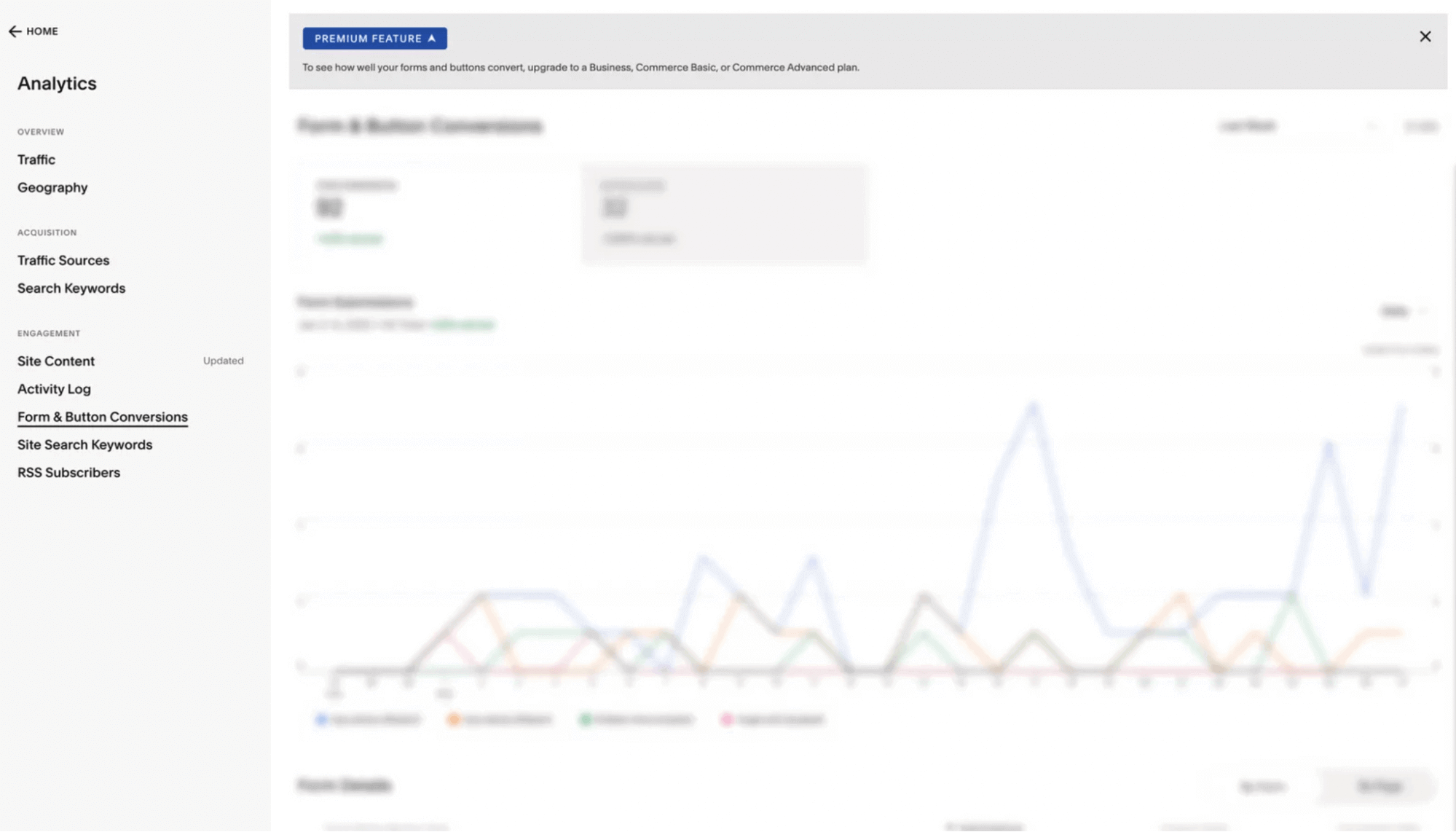

Limited-time offers, seasonal sales, bundles, pop-up reminders, and contextual upgrade prompts can help you entice your buyers and make them crave a more feature-rich plan. You can also tease your users by showing a glimpse of what they can get through a blurry screen.

For example, SquareSpace shows a blurry screen and displays a banner at the top to encourage users to upgrade their plan to view traffic data.

This is just one example of how you can get users to upgrade to a premium plan.

4. Encourage referrals

Referral programs can be a great way to acquire new buyers in addition to growing profits from existing ones. Your users will be more likely to stick with your product and promote it further if their friends and colleagues are using it as well.

Referrals also help you lower your acquisition costs, get fast and reliable conversions, and increase positive brand awareness.

5. Track your results

The last step is measuring your results so you can compare different tactics and adjust your strategy accordingly if needed. Now that you know which metrics impact your net dollar retention, you can choose analytics tools that provide you with a complete picture.

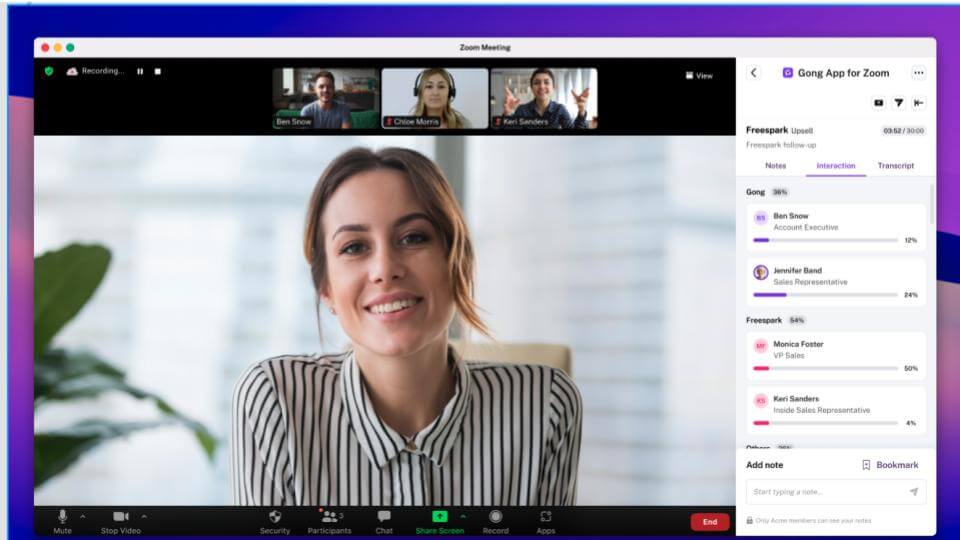

Get more visibility with Gong

Now that you know what NDR is, you can see that achieving a good net dollar retention rate requires consistent effort. Customer-facing teams need to work in alignment to exceed customer expectations and get ahead of churn.

Meet Gong for customer success — the only tool you need to give your CS team visibility into customer journeys and account health.

With Gong, you can:

- Capture every buyer interaction to provide your team members with rich context

- Recognize the early signs of churn and act on them before it’s too late

- Analyze your team’s conversations and uncover coaching opportunities

- Create tailored playbooks to keep your team aligned with customers

- Equip your new hires with call libraries to onboard them for success

Book a demo to see Gong in action.