How to calculate and optimize your CAC-to-LTV ratio to maximize business growth

You have to spend money to make money — and that’s especially true when acquiring buyers. But how do you know whether your investments in customer acquisition are actually paying off?

One of the best ways is to calculate your CAC LTV ratio.

This ratio directly compares your customer acquisition costs (CAC) to their lifetime value (LTV), allowing you to measure the exact return you’re getting on your customer investments. Calculating your CAC LTV ratio can also help identify your most valuable buyers, and even key areas for improvement.

In this article, we’ll run through the basics of the CAC LTV ratio and how to calculate it, as well as provide a few helpful tips for boosting your ratio and staying competitive.

JUMP TO EACH SECTION TO LEARN MORE:

What is a CAC LTV ratio?

A CAC LTV ratio (also known as a LTV CAC ratio) is the ratio between a buyer’s Customer Acquisition Cost (CAC) and their Lifetime Value (LTV). In other words, it’s exactly how much value a buyer returns for every dollar spent in acquiring them.

While there’s plenty of room for ambiguity in calculating both CAC and LTV, both sales metrics are usually expressed in dollar amounts. As a result, it’s necessary to associate every cost and value monetarily, even if there isn’t a clear cost association.

For example, while you may not be able to get an exact dollar amount for how much ad spending it took to convert a specific buyer, you may be able to achieve a “good enough” estimate by taking an average of all buyers. Similarly, limiting the analysis to only known variables (e.g. established sales and marketing costs) may also be enough.

Thankfully, it doesn’t take laser-focused precision to get a useful (read: accurate) CAC LTV ratio. While you’ll definitely want reasonably accurate figures for marketing expenses, revenue, and so on, the calculations are usually very forgiving.

To put this in perspective, let’s take a closer look at both LTV and CAC calculation, and how you can compare them.

What is CAC?

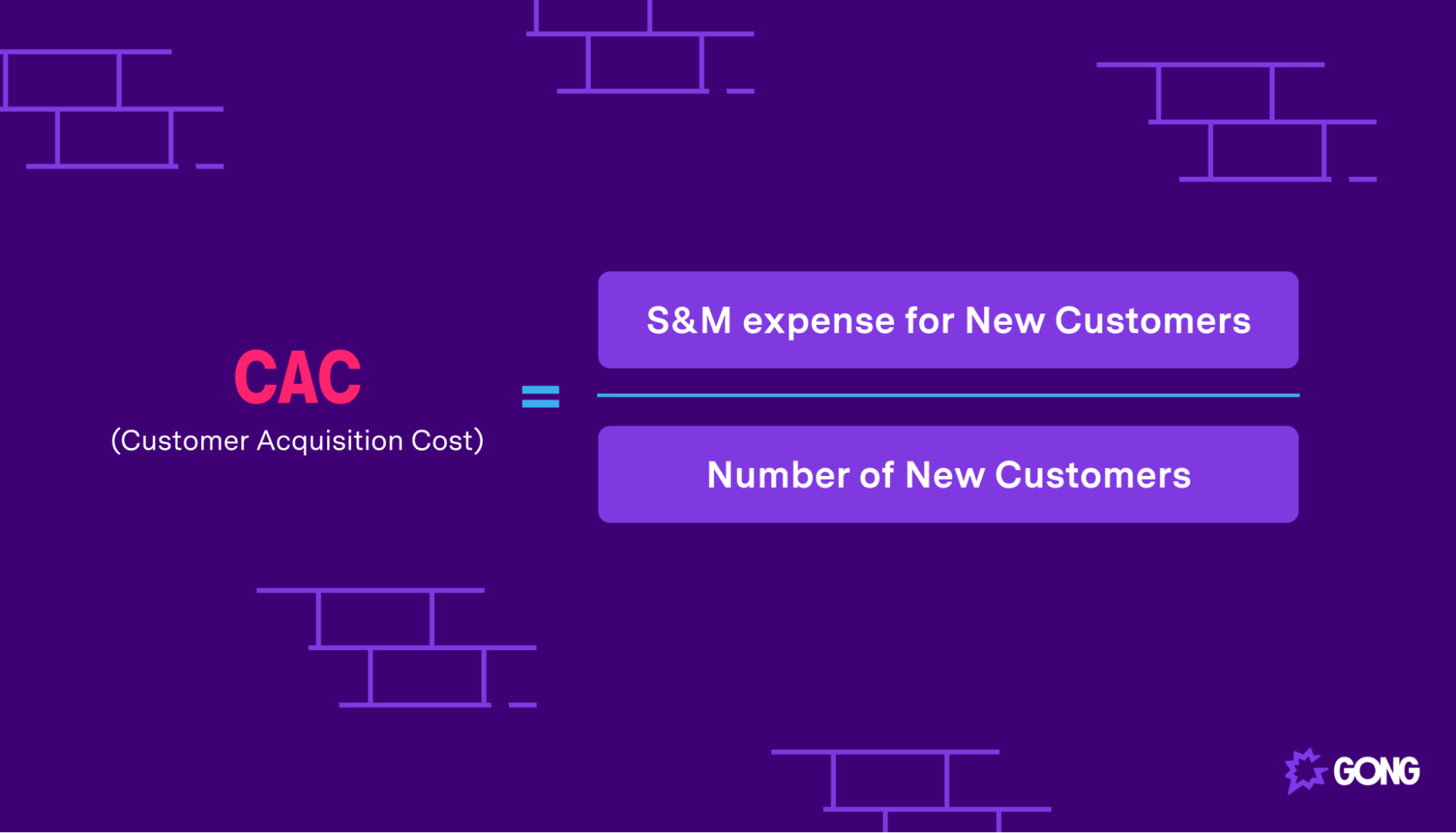

Customer acquisition cost (CAC) is the monetary cost of acquiring new buyers. For most businesses, CAC is expressed by the following formula.

CAC is the ratio of the total sales and marketing expense (or S&M expense) spent to acquire a certain number of new buyers. This ratio is essentially the average customer acquisition cost per new buyer.

For example, suppose a company invested $10,000 into their sales and marketing initiatives (such as a go-to-market strategy for a new product). If this investment resulted in 100 new buyers, their average CAC would be $10,000 / 100 = $100 per buyer. In other words, the company has an average customer acquisition cost ratio of $100 per buyer.

Note that there isn’t an objectively “good” or “bad” CAC — it all depends on the company and product. While a CAC of $100 would be great for a $5,000 product, it would be very, very bad for a $10 product. We’ll be able to determine this by calculating the customer lifetime value (LTV) in the next section.

What is LTV?

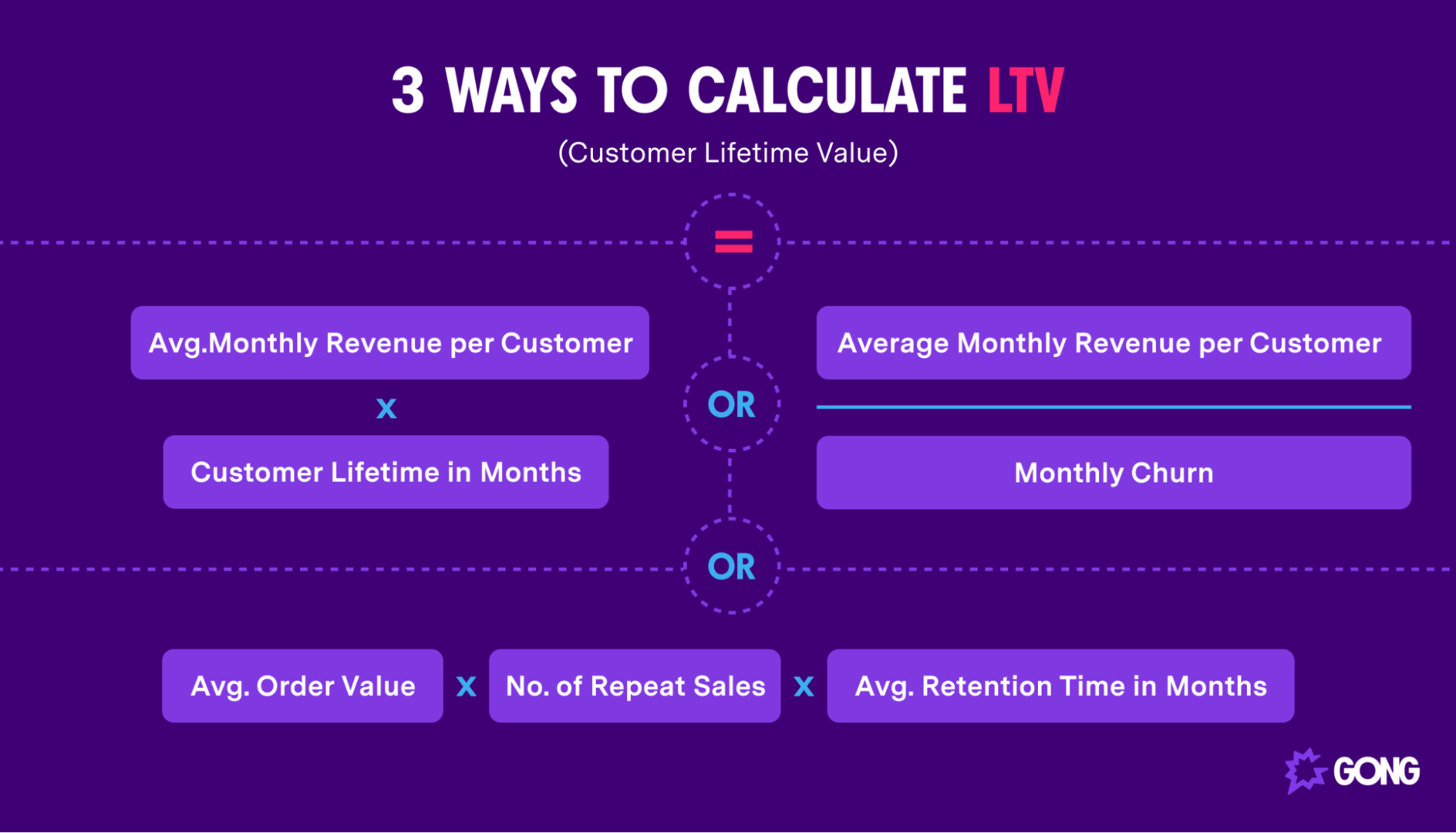

Lifetime value (LTV) is the total value (usually revenue) a buyer generates over their “lifetime” with the company. LTV can be expressed by several formulas depending on the company or product.

Generally speaking, LTV is the total revenue generated by a buyer over a certain period. For SaaS and ecommerce companies, this is usually dependent on average monthly revenue per buyer, since their business model usually operates under monthly subscriptions or other recurring monthly purchases.

For example, suppose a SaaS business charges an average of $100 per month for an analytics platform. If a buyer uses the analytics platform for 24 months, then their LTV is $100 x 24 = $2,400. Similarly, if another buyer uses the analytics platform for 12 months, then their LTV is $100 x 12 = $1,200.

Note that LTV can be calculated as an average or on a per-customer basis.

An ecommerce company might take an average by multiplying the average purchase value by the number of repeat sales and the average customer retention rate (in months). For example, if a product has an average order value of $50, and that product has 5 repeat sales over an average of 12 months, then the average LTV is $50 x 5 x 12 = $3,000.

Just like CAC, a buyer’s LTV can be either good or bad depending on the context of the product and the average CAC — something we’ll see more of in the next section.

Comparing CAC and LTV

CAC and LTV depend on each other to provide meaning and context.

For example, a “high” LTV might not actually be very high if the average CAC is close to or exceeding it. Similarly, a “low” LTV might be very good if the average CAC was very low.

Clearly, “high” and “low” are entirely subjective here — especially where every company has different pricing, subscription models, acquisition costs, and so on. Instead, it’s the ratio between them that makes all the difference.

That’s where the CAC LTV ratio comes in. By taking the ratio of LTV to CAC, companies can get a more accurate measure of a buyer’s “true” LTV by basing it on acquisition costs. As you might imagine, you want your CAC LTV to be at least 1:1, which is where a buyer generates enough revenue (LTV) to cover their acquisition cost (CAC).

Of course, different CAC LTV ratios have different meanings — some of which aren’t entirely obvious. As we’ll see later, even a high CAC LTV ratio can indicate areas for improvement!

Who uses CAC LTV ratios?

Businesses use CAC LTV ratios to measure the effectiveness of customer acquisition. Here, “effectiveness” isn’t the same as simply acquiring a large number of buyers — instead, it’s maximizing the return on investment in customer acquisition.

This metric is useful for many reasons, and for many different people.

- SaaS and ecommerce companies: Since customer LTV is commonly based on recurring payments over an extended period (e.g. subscription or repeat purchases), CAC LTV ratios are especially useful for SaaS and ecommerce companies that use this model. Of course, any company can calculate their CAC LTV, though it may not be entirely relevant for some.

- Sales teams: CAC LTV ratios are excellent metrics for sales teams, especially when it comes to identifying (and selling to) valuable buyers or seeing if there’s room for improvement. For example, sales teams might redouble their efforts on especially valuable buyers (i.e. those with high CAC LTV ratios), or measure whether their sales and marketing strategy is cost effective.

- Investors and venture capitalists: Potential investors often look for high CAC LTV ratios (often between 1:2-1:4) to identify promising returns and areas of underspending. Having both these qualities in place can indicate that more investment could lead to additional revenue.

CAC LTV ratio vs LTV CAC ratio

While “CAC LTV ratio” and “LTV CAC ratio” are used interchangeably, both mean the same thing: The ratio of a customer’s lifetime value (LTV) to their acquisition cost (CAC), i.e. LTV-over-CAC.

How do you calculate CAC LTV ratio?

Calculating a CAC LTV ratio is fairly simple, assuming you already have a reliable CAC and LTV to work with. However, what’s not so simple is figuring out what different ratios mean, and how to change them.

LTV to CAC ratio formula

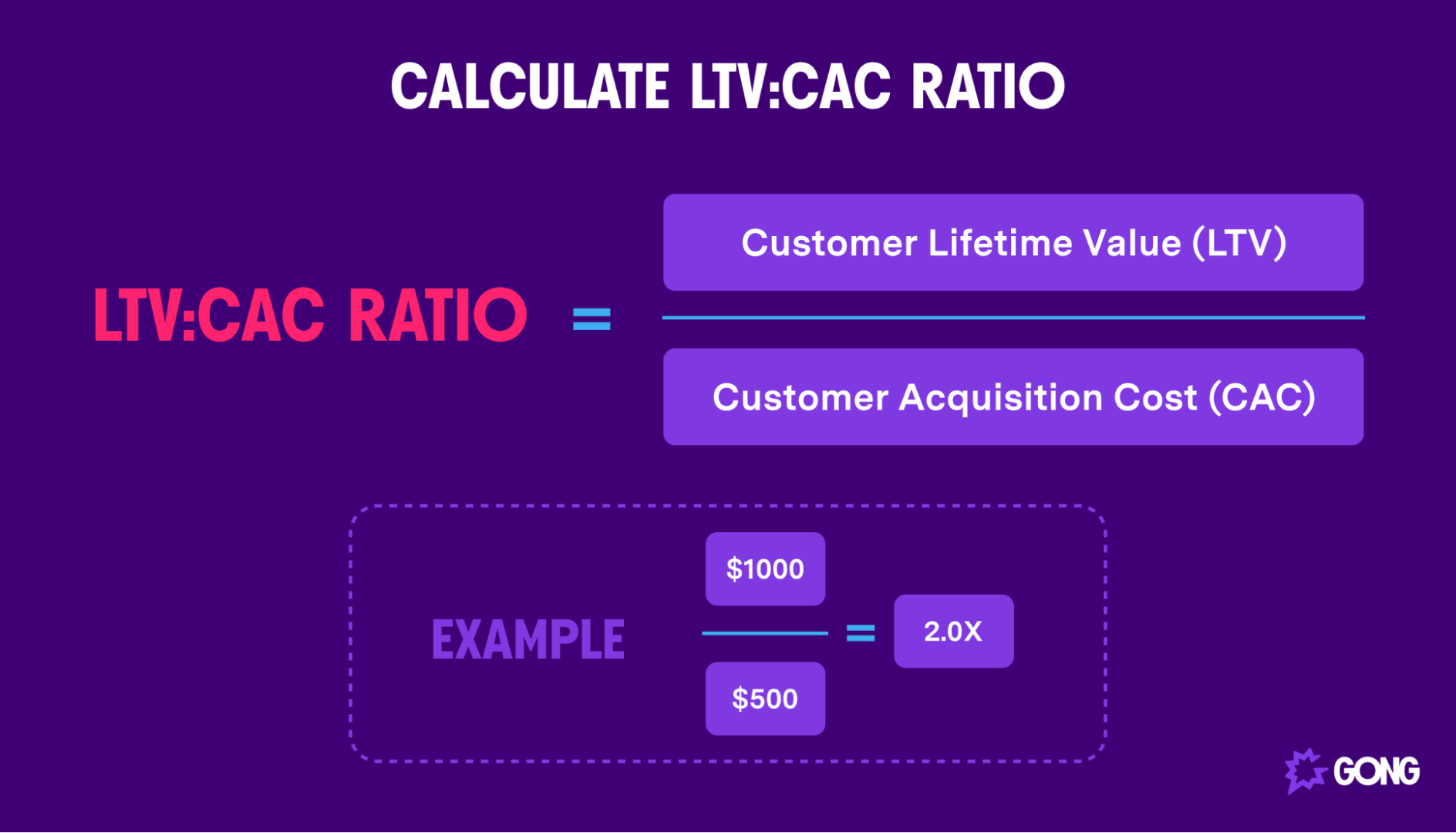

The CAC LTV or LTV CAC ratio formula is expressed by the following formula:

Here, the CAC LTV ratio is simply a buyer’s LTV divided by CAC, whether the CAC is specific to the customer or the average for a pool of customers.

For example, suppose a buyer pays $100 per month to a SaaS company for 10 months. Meanwhile, the SaaS company has spent an average of $5,000 on sales and marketing to acquire 10 new buyers.

What is the buyer’s CAC LTV ratio?

- Calculate LTV. Since the buyer paid $100 per month for 10 months, their lifetime value to the company is $100 x 10 = $1,000.

- Calculate CAC. Since the company gained 10 new buyers for spending $5,000 on sales and marketing, the average customer acquisition cost is 5,000 / 10 = $500.

- Divide LTV by CAC. With an LTV of $1,000 and a CAC of $500, the buyer’s CAC LTV ratio is $1,000 / $500 = 2.0.

With a CAC LTV ratio of 2.0, we know that the buyer generated twice the amount of money it took to acquire them — a 200% return.

What is a good LTV to CAC ratio?

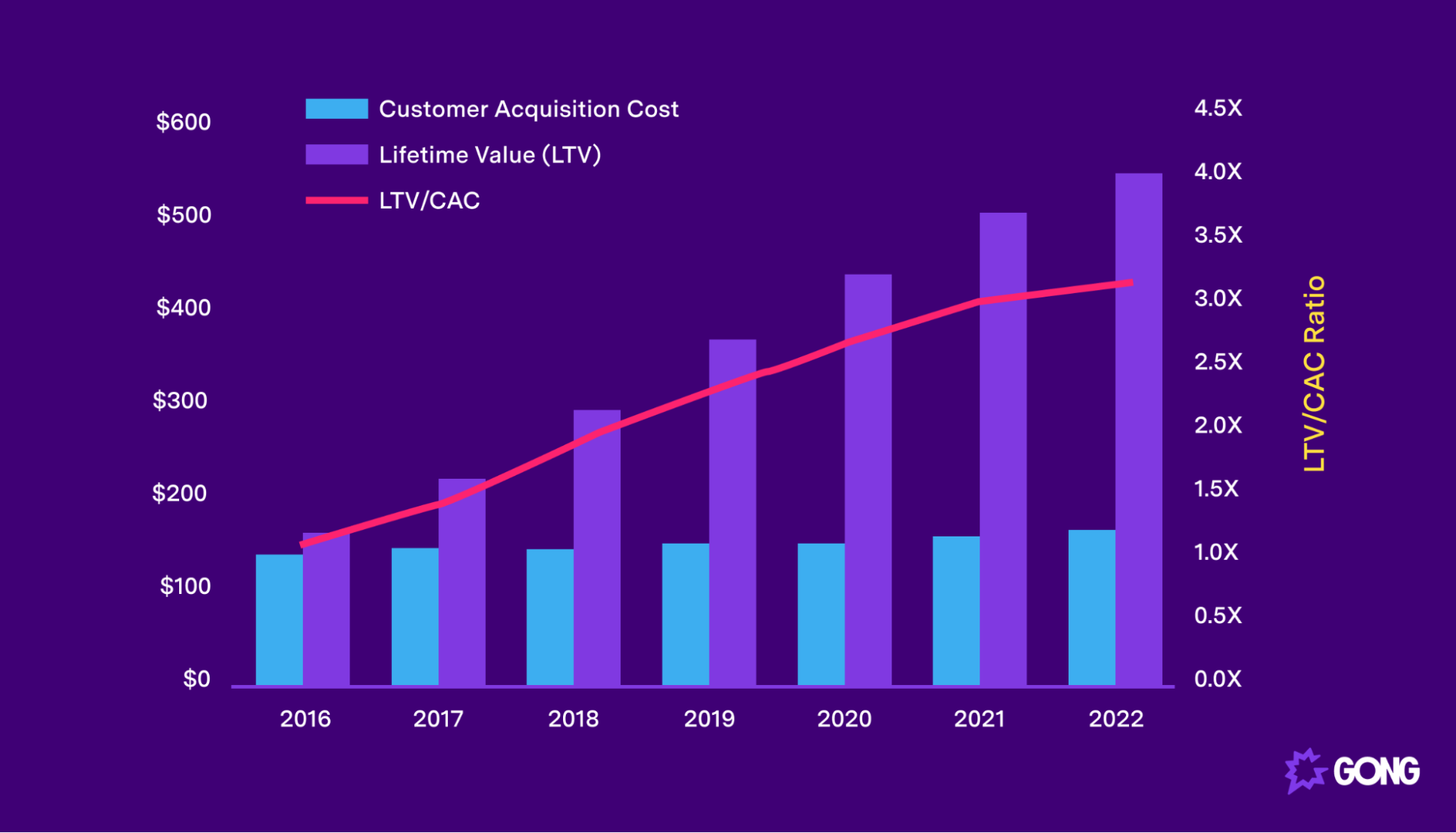

CAC LTV ratios typically range anywhere from 0 to 5 (or above). But which one is “best?”

Generally speaking, a good CAC LTV ratio is about 3.0. This ratio indicates a healthy return on investment without leaving too much extra growth on the table.

Here are the typical LTV to CAC ratios a company might encounter.

- LTV is less than CAC (<1.0): The company is spending more than they’re earning back from the buyer. They’ll either have to spend less on sales and marketing, or find some way to alter their pricing scheme.

- LTV is equal to CAC (1.0): While this might seem like a breakeven point, it usually isn’t. Since CAC only accounts for sales and marketing expenses, the company will probably still be losing money once other costs (taxes, maintenance, etc.) are accounted for.

- LTV is more than CAC (2.0-4.0): This is usually the “sweet spot” where the company is seeing a return of 2-4 times their investment in customer acquisition. They probably won’t have much room for additional sales and marketing after accounting for other costs, which often indicates an optimal return.

- LTV is much more than CAC (5.0+): Many case studies indicate that a company’s CAC LTV ratio can actually be too high. While a huge return is great, it often indicates that there’s still room to spend and earn more on customer acquisition.

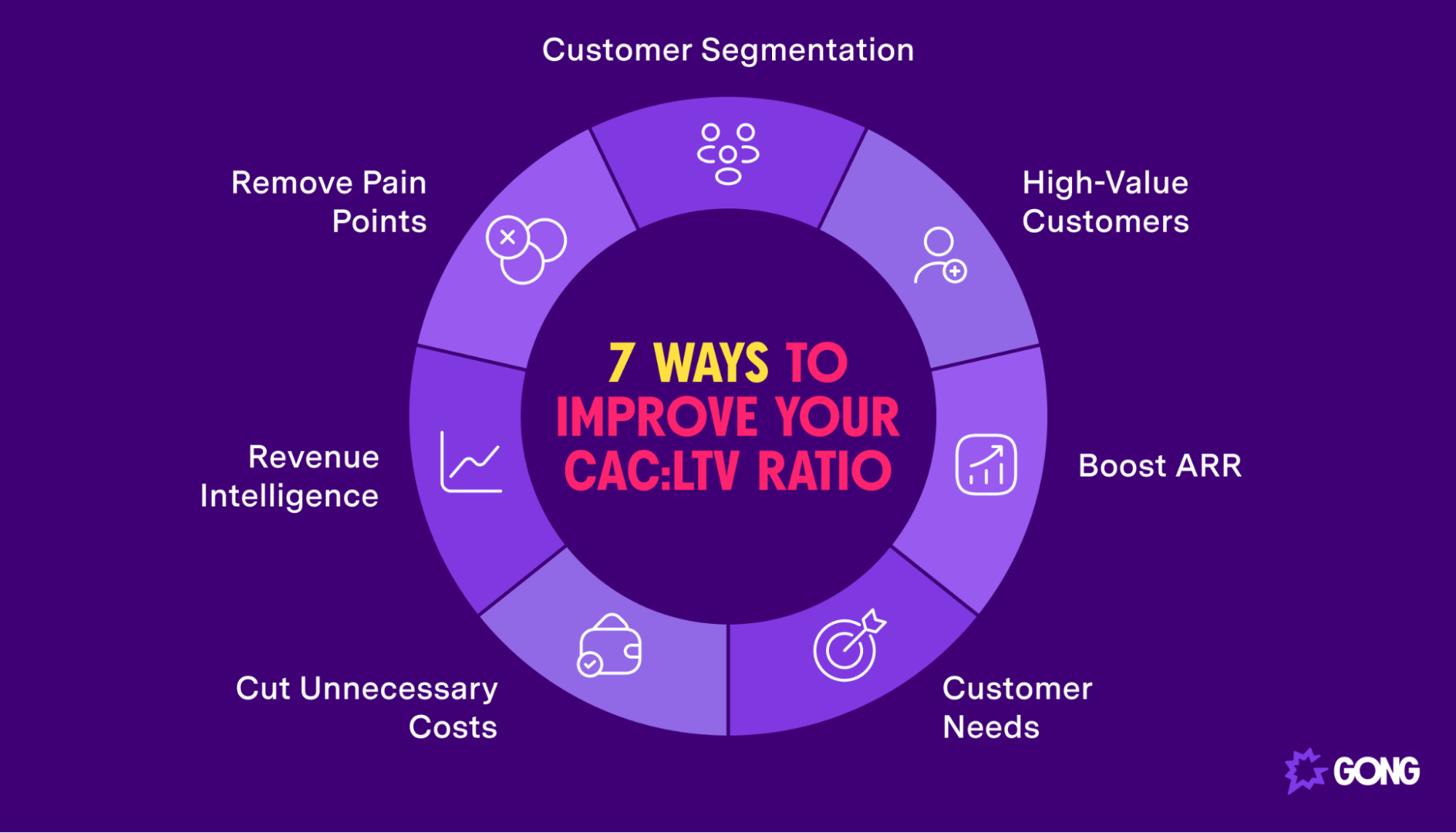

How to improve your CAC LTV ratio

Whether too low or too high, there’s plenty of ways to improve your CAC LTV ratio.

Generally, low CAC LTV ratios can be increased by either increasing revenue or decreasing customer acquisition costs. Similarly, high CAC LTV ratios can be decreased by spending more on custom acquisition.

Try these effective strategies for boosting your CAC LTV ratio (especially if it’s low).

1. Use buyer segmentation to fine-tune campaigns

Not all buyers are equal — and the process of acquiring one buyer may be completely different than that of another. By fine-tuning your sales and marketing campaigns to different buyer segments, you can allocate sales and marketing expenses more effectively, which will lower your CAC and, in turn, boost your ratio.

2. Pay extra attention to high-value buyers

In some cases, selling slightly more to a single high-value buyer can be easier and more profitable than selling to a large group of low-value buyers. By giving them extra attention, you can boost your most powerful LTVs and improve your ratios across the board.

3. Find ways to boost annual recurring revenue (ARR)

Boosting your annual recurring revenue (ARR) is an effective way to boost the LTV of your buyers, and, as a result, your ratio. Some ways to boost ARR include (carefully) increasing subscription prices for new buyers, creating add-on services, and finding more buyers.

In the case of a high ratio, you may need to spend more on customer acquisition to increase both customers and ARR.

4. Address buyer needs

The key to both high LTVs and better ARR is increasing customer lifespan — in other words, keeping them happy. While there are many ways to do this, one of the most effective is to identify and address their specific needs. If they feel taken care of, they’ll be more likely to spend more for longer.

5. Stop spending in ineffective areas

Reducing your CAC is one of the most effective ways to improve any ratio — and one of the best ways to do so is divert investments away from ineffective areas of your sales and marketing efforts. Companies can expect a double benefit if these costs are re-invested in areas with proven sales efficiency.

6. Solve customer problems and remove pain points

By extension of addressing buyer needs, you should pay special attention to buyer problems and pain points. By knowing and addressing these issues, you’ll not only improve the LTV of your current buyer, but also draw in new buyers looking for similar solutions.

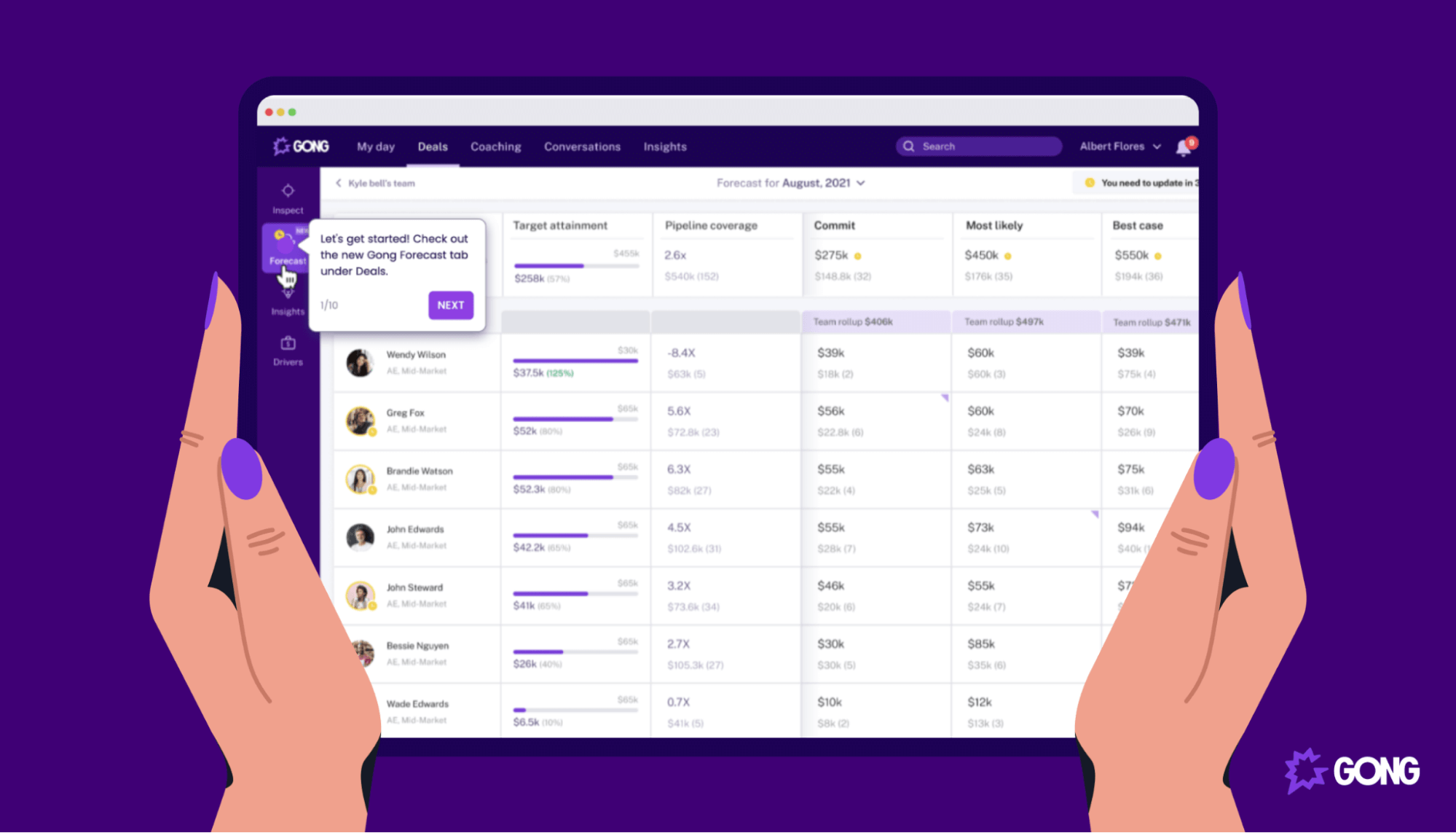

7. Use revenue intelligence tools

Improving and maintaining an optimal CAC LTV ratio requires closely monitoring not only your revenue, but just about everything else throughout your sales pipeline.

While it’s possible to keep track of these points through a variety of tools, using a revenue intelligence tool is the most effective way to keep everything in one place.

With total visibility at all points in your sales process, you’ll be better equipped to increase customer value, fix inefficiencies, and invest in your most valuable buyers — all of which lead to a healthy CAC LTV ratio.

Boost your CAC LTV ratio with revenue intelligence from Gong

Ready to boost your CAC LTV ratio?

With Gong’s Reality Platform, you can automatically capture sales communications and get AI insights to help you see what works (and what doesn’t).

With additional features for forecasting risk, tracking strategic adoption, and even coaching and task automation, Gong gives you the tools you need to make the most of your sales expenses.

Request a free demo and see why Gong is the #1 choice for over 3,500 customers.