While volatility can make sales exciting, it doesn’t always lead to stable payouts for sales representatives.

Should low sales always translate to low pay? How can managers and reps strike a fair balance?

Enter the sales commission structure, which outlines how a company pays their sales reps based on performance. Sales commission structures or compensation plans can take on a wide range of forms, with the best providing sales reps both financial stability and an incentive to make more sales.

But which sales commission plan is right for your sales department? In this article, we’ll explore the many types of sales commission structures, which ones are most common, and some general tips for choosing one that’s fair for everyone and best for your sales organization. Read on to learn more!

Why have different types of commissions and commission structures?

Earning commissions are essential for keeping sales people motivated and hungry to sell more. But not all commissions are equal, however — nor is any one type of commission plan appropriate for every company, product, or sales team.

Instead, most high-performing companies try to adopt a unique sales commission structure that gives sales teams the commissions they deserve without negatively affecting the bottom line.

As you might imagine, establishing an effective commission model with a reasonable commission rate is highly dependent on multiple variables, such as the net revenue of each sale, the size and scope of the sales team, the frequency of sales, and even the product itself.

While these variables can vary, the goals — and their necessary balancing points — remain the same:

- Compensate salespeople fairly and consistently without overpaying for non-productivity

- Motivate salespeople to sell more and go “above and beyond”

- Retain salespeople to make the most of previous training and product familiarity

Sales commission plans also help companies retain salespeople if sales are inconsistent, or if they don’t have the budget for a full-time sales team. Again, situations can vary, as do their associated commission structures.

For most companies, achieving these balances usually comes down to changing their compensation plan by adding a small per-sale sales commission rate on top of an existing salary — usually 10–20% of their overall pay. This helps keep valuable salespeople while giving them a healthy (i.e., not bottom-line-breaking) incentive to keep working hard.

Of course, a commission plan such as an 80:20 salary-to-commission ratio is only one of many potential examples (though it may be among the most common). Before we dive into other commission structures, however, let’s take a closer look at different kinds of commissions.

What are the different types of sales commission structures?

Commissions aren’t always just a “straight cut” of total sales — they can also be based on a person’s regular salary or the amount of the work they performed. These variations are typically grouped into three major categories:

- Straight commission: Wage is calculated solely as a set percentage of sales. For example, if a sales rep sold $25,000 worth of product in one week and had a straight commission of 10%, then their wage for that week would be $2,500. Note that this is the salesperson’s only pay under a straight commission.

- Graduated commission: Wage is calculated as a combination of existing salary and a tiered (or graduated) commission. For example, if a sales rep has a salary of $250 per week and earns 20% commission on the first $10,000 in sales and then 10% commission on the next $10,000, then their wage for a week of $15,000 in sales would be $250 + $1,000 + $500 = $1,750.

- Piecework commission: Wage is calculated as a flat rate per sale or work completed. For example, if a sales rep is paid a piecework commission of $200 per sale and makes 10 sales in one week, then their wage for that week would be $2,000.

As we’ll see in the next section, these basic commission types can be combined or structured in many interesting ways.

How do you structure a sales commission plan?

So how do you know what type of commission structure is right for you?

It depends. Looking at our examples from earlier, you can probably imagine scenarios where one type of commission is more appropriate than another. For example, paying a graduated commission might make little difference if sales volumes are relatively small.

Other factors such as turnover, industry standards, and on-target earning (OTE) also influence commission plans. Again, the primary goal is to motivate salespeople and avoid turnover without breaking the bottom line.

What is the most common commission structure and why?

The most common commission structure is base salary plus commission. While this is technically a form of graduated commission rate, it doesn’t always come with graduated commission tiers based on revenue — a salesperson might get paid a base salary plus a straight commission rate or a base salary plus a piecework commission rate. It all depends on the company, the product, and, of course, the money.

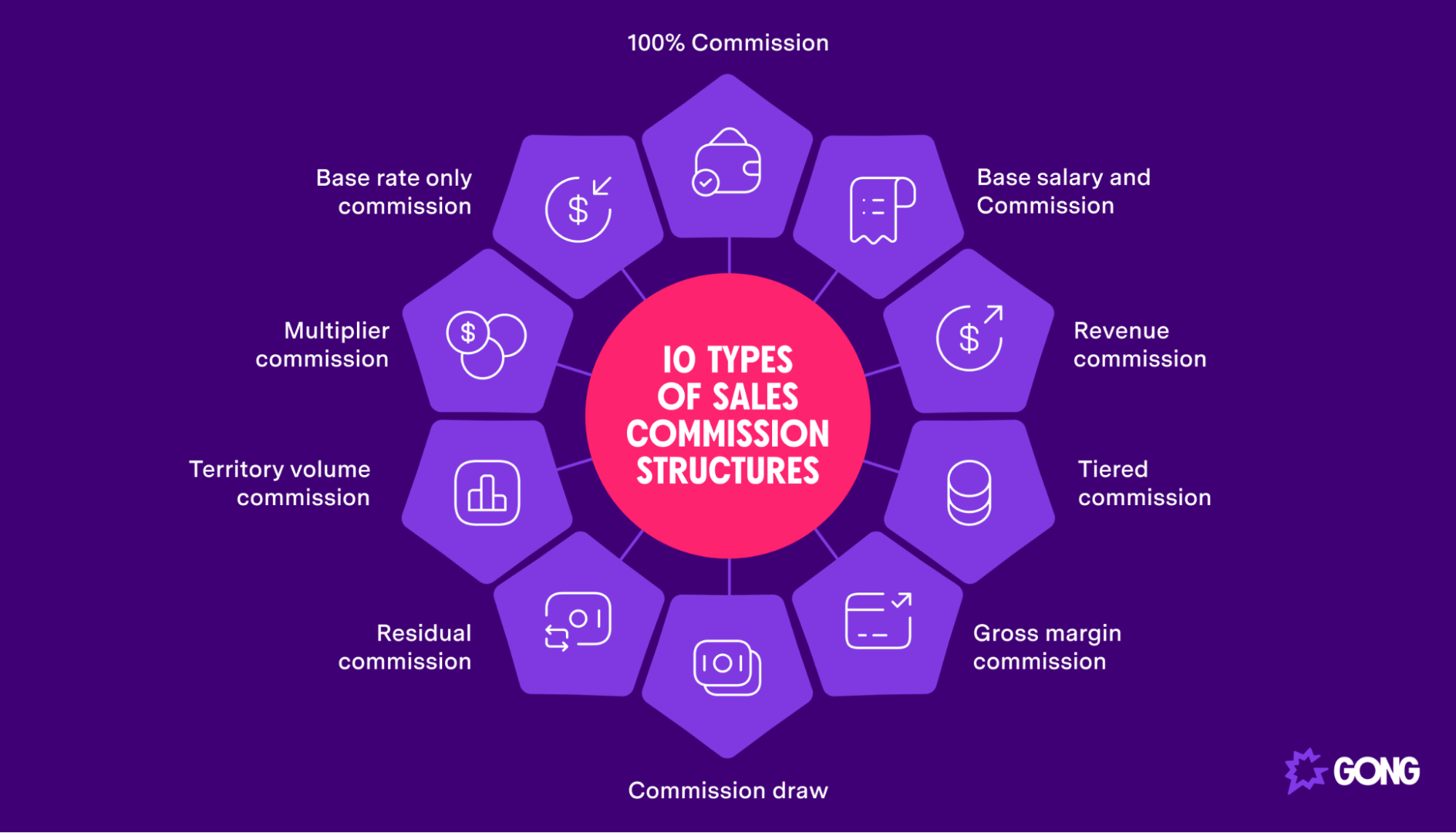

10 types of commissions

Now that we know the basics of commissions, it’s time to see how they’re used and structured in the real world.

While there are plenty more types of sales commission structures than we have room to list, here are the ten most common compensation strategies you’ll encounter.

1. 100% Commission

Essentially a form of straight commission, 100% commission is exactly what the name implies: the salesperson gets paid solely in commission with no base salary.

While a straight commission might sound risky, it can be the ideal structure in many situations — especially if the company doesn’t put a cap on total commission payouts. With no caps on earning potential but nothing to back up their salary, salespeople under this payment structure will be extra motivated to sell as best they can to meet their sales targets. Other benefits of this structure include speed to market (i.e., no overhead required for sales staff) and having an easy way to gauge sales performance.

Despite these benefits, however, a 100% commission percentage isn’t always appropriate: salespeople earning a straight commission will be considered independent contractors, and a straight commission can also leave sales reps with too little (or too much) income.

2. Base salary and commission

Base salary plus commission is by far the most common sales commission structure. Here, salespeople earn a base pay (either hourly or salary) and then a commission on top of it.

The actual salary-to-commission ratio can vary, however. Typically, the base pay isn’t enough to be considered a livable income for the salesperson. Instead, it provides them a buffer for “slow” periods while incentivizing them to sell more (and, as a result, make more).

This structure often provides the best of both worlds, allowing companies to save money while avoiding turnover, while also allowing salespeople peace of mind and the flexibility to invest in their skills.

3. Revenue commission

Whether there’s a base salary or not, there’s often the question of how to structure the commission itself.

The most common approach is a revenue commission, which is based on a set percentage of revenue. This is what we’ve encountered so far, where a salesperson with a revenue commission of 10% would earn $100 on a $1,000 sale.

A major benefit of this sales commission is that it’s straightforward and easy to understand. Both companies and salespeople know exactly what to expect from each sale, and the structure makes sure that top performers get top pay. While it can definitely cut into profits, it’s a good structure for already profitable companies looking to grow into new areas with minimal risk.

4. Tiered commission

A tiered or graduated sales compensation plan can be useful for further rewarding sales past certain milestones. A typical tiered commission structure might offer 5% commission on the first $10,000 in sales, then 8% commission on all sales past that point.

Tiered commissions usually serve to motivate sales reps and encourage them to surpass major sales goals and milestones. The opposite can also exist to penalize underperformers or to ensure that salespeople reach a certain goal, such as offering only 80% of their normal commission for sales under a certain amount.

5. Gross margin commission

As the old saying goes, you have to spend money to make money — and a gross margin commission structure is the best way to account for this.

Where revenue and tiered commissions take a “straight cut” of the sale, gross margin commissions factor in the company expenses necessary to make the sale (travel, food and beverage, etc.) and only pay the salesperson the difference.

For example, suppose a salesperson makes a $1,000 sale, but the sale had $200 in expenses. Under a gross margin commission, the salesperson would walk away with $1,000 – $200 = $800 (i.e., the gross margin of sales revenue).

6. Commission draw

A commission draw guarantees a minimum monthly salary for salespeople by paying the difference between salary and commission as a sort of flexible “base salary.”

Note that this is nothing like the “base salary plus commission” structure we covered earlier. For example, if a company guarantees a monthly salary of $3,000 but a salesperson only makes $2,500 in sales one month, then the company will pay an extra $500 to guarantee their $3,000 monthly salary. However, the extra amount is usually deducted from the next month’s commission.

While it may sound a bit overcomplicated, commission draw is a great way for new or growing companies to guarantee salaries without having to set money aside. This allows companies to stay flexible and keep dedicated salespeople while spending the bare minimum.

7. Residual commission

Residual commission rewards salespeople for securing long-term customers by paying them a regular commission for as long as that customer stays with the company. This is usually appropriate for companies offering monthly subscriptions, recurring payments, or long-term contracts with regular renewals.

8. Territory volume commission

Territory volume commission ensures that every salesperson within a certain territory receives the same commission. For example, if a territory has three salespeople and they make $1,000, $700, and $1,300 in sales, each of them might receive the average ($1,000).

While this can sometimes help promote team dynamics, some high-performing salespeople may feel like they’re carrying the weight of under-performing team members.

9. Multiplier commission

Multiplier commission takes the typical revenue commission (i.e., a set percentage) and multiplies it by a modifier depending on a salesperson’s success. For example, a salesperson who meets their quote might have their regular commission multiplied by 1.25 for a 25% bonus.

Though multiplier commissions can be a valuable incentive tool, many companies and salespeople alike find it introduces unnecessary complexity into otherwise fair and straightforward sales commission models.

10. Base rate only commission

Some companies abandon commission structures altogether and simply offer their salespeople the “base rate only” – in other words, an hourly wage or salary. This is rarely successful, since removing sales compensation can also remove a salesperson’s motivation or incentive to sell.

How to choose a sales commission structure

Clearly, there’s many different ways to create a commission structure. But which sales commission is right for you and your sales talent?

While there’s no one answer, following these tips can help you identify the most promising options. And don’t forget that you can combine different commission structures to achieve a combination of goals.

Review annual sales goals

Your sales goals will likely be the biggest factor in determining your commission structure. For example, if you wanted to increase sales 25% and keep 50% of existing customers, then you might choose a combination of 100% commission and residual commission to incentivize salespeople to attract and keep customers, respectively.

Review budget and revenue goals

Even the most well-intentioned commission structures are limited by budget and revenue. Make sure that your budget, expected revenue, and expense estimates are enough to compensate both your salespeople and your company. A gross margin commission structure could help with extra sales and marketing expenses.

Evaluate each sales role

Since every salesperson is different, it’s crucial to look at each one and identify their sales strengths (and weaknesses). In doing so, you’ll see where they’re most effective, which could help inform which sales commissions would be most incentivizing.

Determine KPIs for each sales role

How do you measure success, and what is a “sale” for your company? How many sales do you expect over a certain time frame? Defining these and other key performance indicators (KPIs) such as deal size and win rate can also help define the specifics of your commission structure.

Consider your product’s pricing structure

Are your sales a one-time purchase or do they lead to recurring payments (e.g. monthly subscriptions or contract renewals)? Does your pricing structure lend better to a one-time commission or a residual commission?

Review commission structures with sales reps

Whichever commission structure you choose, always review it with your sales reps first. Remember, the goal of a commission structure is to motivate and reward your sales professionals!

Analyze performance with revenue intelligence tools

As we’ve seen, fine-tuning your commission structure relies heavily on analyzing performance and sales data over time. Using revenue intelligence tools is one of the best ways to identify your sales department’s strong areas and further incentivize your most effective sales strategies.

Optimize sales with revenue intelligence from Gong

Your sales commission structure makes all the difference when it comes to keeping your sales teams productive and motivated. With revenue and sales intelligence from Gong, you can have intelligent insights into your sales pipeline, deals, buyers, and sales team performance — everything you need to know to create an optimal commission structure and become a sales leader.

Ready to do sales smarter? Request a free demo today.