Driving growth: the role of revenue operations in modern companies

Customer lifecycle.

Someone’s got to own that motion.

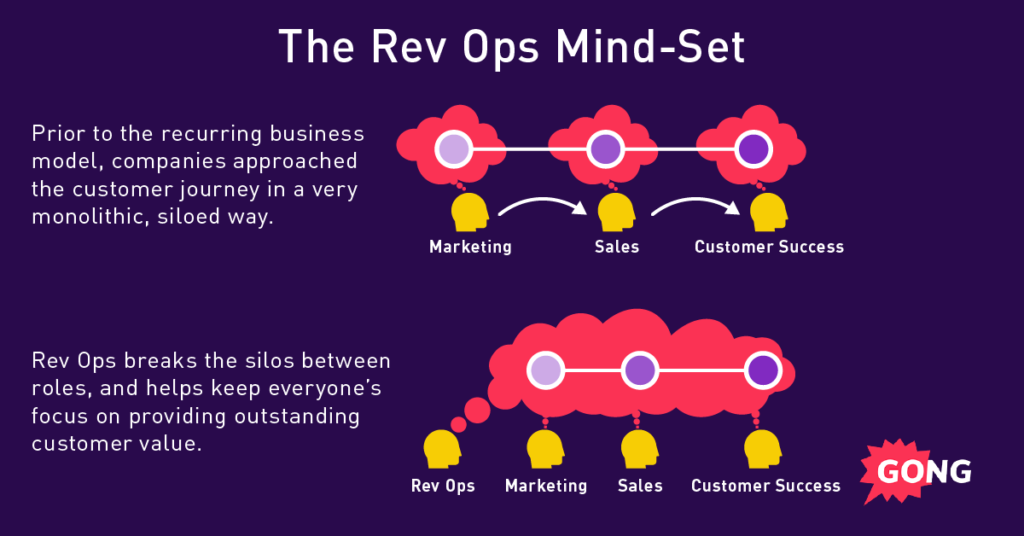

Someone’s got to understand what the outcomes of the strategy are, orchestrate all these different groups, and break the silos between all these different operational efficiencies that are being optimized within the silos.

That someone?

Revenue Operations (RevOps for short).

But how is that different from what we’re already doing? Is Revenue Operations just a fancy new term?

Three major factors have changed and added complexity to revenue generation:

- Buyers buy differently. They know a ton about your product before your reps even speak to them (because internet).

- Sales teams can’t keep up with their tech stack. Even if they could, their stack isn’t integrated with other teams’ stacks to produce the insights they should.

- GTM leaders are demanding reliable and predictable growth.

That’s why modern go-to-market teams started aligning those teams a while back.

Done well, RevOps means higher revenue and a smoother go-to-market (GTM) process.

It also means switching the focus from the sales process to the buyer’s journey:

It’s not about you, it’s about them.

The only way (I’ll say it again), the only way that a GTM exec can make an informed decision is if their marketing, sales, and customer success teams are aligned in their mission, messaging, and monitoring. Integrating the data from all three teams means there’s a cohesive picture of the buyer’s journey and points of influence can be tracked.

When those GTM execs ask you, “What is RevOps?” tell them it’s the centralized umbrella under which three critical, customer-facing teams and their data work together to create reliable and predictable growth.

And it’s here to help them win.

Revenue Operations vs Sales Operations: Same but different?

The short answer: while they share the same goal, Sales Ops and Revenue Ops aren’t interchangeable.

They both support revenue growth BUT their focus is different.

Sales Ops: tools and processes to accelerate the sales motion.

Revenue Ops: tools and processes to accelerate pipeline generation (marketing and sales dev), sales, and post-sales (CS, AM) motion.

Make sense?

Ok. So what does a Revenue Ops team look like?

Building a Revenue Operations team

Once you’ve moved your org beyond ‘What is revenue operations”, they’ll know that it’s more than hosting a few cross-functional meetings.

It’ll require a dedicated team to cover core rev ops functions:

- CRO/VP Rev Ops: They understand how sales, marketing, and customer service each contribute to revenue and think strategically about how to streamline and align processes across the company to create a buyer journey that puts the customer at the center.

- Revenue Operations Manager: They use data (a lot of data) to determine which business objectives and strategies will drive revenue, based on the new strategic vision. They’re process-oriented: They take the vision set by the CRO and create processes to operationalize it.

- Revenue Operations Analyst: A more analytical counterpart to the RevOps manager, analysts run data from all systems to perform cohort analysis, TAM analysis, and closed-lost analysis to identify growth opportunities for the business.

- Revenue Enablement/Sales Enablement: They work hand-in-hand with managers on all three teams (marketing, sales, customer success) to implement new processes and streamline activities. They’re on the ground, supporting teams to implement the strategy.

A high-functioning RevOps team ensures that your marketing, sales, and customer success teams move from being strong solo players to a unified front for revenue generation, in three complimentary divisions.

This team is all about creating cross-functional partnerships.

Do you need a rev ops function?

Don’t build a RevOps team because everyone else has one (or to quiet the folks at the table shouting, What is revenue operations? Do we already have it? Will it eat my budget?).

Build it because you know why you need it.

If you’re unsure, consider the five questions below. If you’re hearing them at your organization, you probably need a revenue operations team.

How can we improve our handover process between teams?

Marketing to SDR.

SDR to AE.

AE to CSM.

There are multiple handoffs in any sales motion.

These critical junctions are where RevOps steps in.

Without it, important information gets lost.

If each person delivers on the expectations set by those who came before them, you generate trust and open doors to additional revenue generation.

Unfortunately, it’s easy for any team member along the way to make a promise that gets lost in the next handoff. And once it’s lost, it’s gone for the rest of the customer journey. That results in customer churn.

Everyone who has contact with a customer needs to be clear about the customer’s business needs, their use cases, their expectations and hopes for the product, and so much more. That means, for example, that your salespeople need to understand what your customer success team can and can’t provide. And customer success needs to understand what the buyer has been promised.

If you’re working as individual teams, that’s tough.

But revenue operations ensures that there are strong links at every handoff and that processes don’t stop and start where each team begins and ends. Processes are continuous and handoffs are smooth, for a fulfilling customer journey.

How can we align goals from different teams?

Is your goal selling to more customers? Increasing initial deal sizes? Boosting annual contract values? Targeting new markets?

If your marketing and sales teams focus on one of those goals and your customer success team doesn’t know about it or how to support it, things can go sideways quickly. Either customer success won’t leverage your sales team’s perfect pitch and setup, or they won’t be able to deliver on anyone’s service expectations.

High-level goals affect the number and type of hires on each team. You have to have the right people in place to execute your plans. If there’s misalignment in investments or training from team to team, there will be glitches in the customer journey.

This all comes back to aligning team goals. When they’re fully aligned — as they would be with revenue operations in place — teams truly support each other. There’s a cohesive picture of where your revenue-generating teams are headed. (Hint: It’s in the same direction.)

If you’re tracking things properly, you’ll see any misalignment in the metrics coming from each team. Which brings us to the next point…

How can we get marketing, sales, and CS teams to work on the same, reliable data?

If each team has its own technology stack — and hence its own data/metrics — you won’t be able to really see what’s happening from A to Z for the customer. Sure, you’ll see how each team is faring on its own, but you won’t have a clear view of the bigger picture.

Your data and analytics won’t help you make bold, strategic plans. It’ll keep you focused on the team level.

Moving to big-picture thinking comes down to what you track and how you track it.

If your data can’t be cross-analysed because the data fields each team tracks aren’t compatible, what good is that data?

That’s the work of revenue operations. They’re gonna paint you a seriously beautiful picture of your world. But they can only do it when everyone’s feeding into (and off of) a cohesive set of data.

How can we rationalize our use of tools across different go-to-market teams?

It’s not surprising that everyone’s building out their own tech stack. They’re hungry for success, and data gathering and analysis tools help them clarify how they’re doing against benchmarks.

But this presents a siloed view of your business. Of your teams. Of your customers.

(Plus, it eats up budget when you pay for duplicate functions.)

If your teams invest in highly specialized tools that aren’t designed to integrate easily with other software, it’s time to teach everyone how to play well together. Use a RevOps approach: Work with tools that integrate or with one overarching tool.

To begin, find out where your customer data lives at each stage of the sales cycle. Is any of it lost as your customer moves through that cycle? If you operate in multiple tools, be certain your teams can reliably share their data.

Next, determine whether each tool’s analytics and insights are shareable across teams as well. You want an overlapping system so teams take action based on what’s happening elsewhere in the cycle. Closed-lost opportunities should be sent back to marketing communications, for example.

You’re primed for tool (and budget) streamlining if any of these are familiar: chats for website visits and in-app, data enrichment for marketing and sales, prospecting tools for sales development and sales.

How can we improve forecast accuracy for the business as a whole?

Forecast accuracy is everything in a world where the C-suite is hyper-focused on reliable and predictable growth.

And it’s about more than one team hitting its quota (though that’s important). Forecast accuracy should clarify whether moves made on several teams combine to get the desired results.

If you have data feeding into your forecast from several teams, you’re more likely to be able to provide leadership with an accurate forecast than you could with info from only one team.

If your forecasts aren’t accurate and you don’t know why, that’s a problem. The more comprehensive your approach to building a forecast, the more likely you are to see where things are going wrong.

Again, if your data doesn’t frame a fulsome picture of your business as a whole, it doesn’t hold much value.

Sidebar: It’s worth saying that if people are asking about forecast accuracy at your org, there may be bigger issues at stake, like investment decisions, hiring forecasts, or even cash flow issues. (Yep, things just got serious.)

Which KPIs should we track?

It’s safe to assume that you’re experiencing at least one or two of those issues. (And if you’re not, call me for your next job offer. You’ve got serious chops.)

If you’re tackling these issues, there’s a way out: revenue operations. Let’s get into the details. Once you make the move into RevOps territory, here’s what you should track:

Total annual recurring revenue (ARR): This is the amount that comes in for a single calendar year over the life of a subscription contract. Track this number for both new business and for your existing customers. It’s a nice comparator to have. You’ll want to see if you can raise both, but particularly if you can get a big boost with new customers based on changes you make to your overarching customer journey.

Customer acquisition cost (CAC): This is the dollar amount you spend on marketing and sales over a given time divided by the number of new customers acquired in that time. It gives you a sense of whether you’re under or over-spending in those two departments. Make adjustments accordingly, and base them on the full-picture view you have of your revenue operations.

Lifetime value (LTV): What’s the value each customer brings in over their lifetime with your org? Make sure it’s in line with your big-picture goals (deal size, ARR, etc.). Are your plans for a new org meeting expectations or are you falling short at leveraging each customer? If so, where is that happening? (Sorry, CS, but we might be looking at you!)

Churn and upsell: Are your customers leaving you for other pastures or spending money to move deeper into your product offerings? Both metrics matter, and both can be influenced by what happens across the entire customer journey. If you have one weak team, that’s good to know. It’s an easier fix. If the entire journey is patchy, it’s time to make major repairs. You’ll need the budget and executive support for major changes.

Forecast accuracy: Are you hitting your revenue-generation targets consistently? If not, where are things going wrong? You’ll need to look at individual team targets, but the point will be to understand the bigger picture. At the end of the day, your job is to enable leadership to make decisions for the entire organization based on your numbers.

Which tools should we use?

Good question.

Your CRM is the backbone of your revenue management tools because it cuts across all three critical teams (marketing, sales, and customer success). It gets everyone working with standardized data fields, which is foundational to your improvement. Make sure teams enter data on the regular and that they understand the importance of good data entry.

When that’s in place, you can add other tools to your roster.

Forecasting tools let you detect purchasing trends in the market and make pivotal business decisions around features, pricing, staffing, etc. While forecasting puts revenue growth into the spotlight, it serves a critical function in helping leadership craft appropriate budgets and allocate resources. Get a free sales forecasting template here.

Pipeline management tools are all the rage for a reason. From seeing where deals stand at a glance to automating notifications and reminders, they make your life easier. The best ones provide a cohesive view across our revenue generation teams. Use this sales pipeline template to get started.

Enablement tools can help you find out whether your content is effective. They’ll spit out some serious scoring to tell you what works and what doesn’t. If you want to pull metrics about where the rubber meets the road (in your sales funnel in particular), these tools are your best bet.

Revenue Intelligence covers these bases (and more)

Want to bring your teams’ moving parts into one, unstoppable go-to-market machine?

Gong’s Revenue Intelligence Platform pulls all of these tools into one ultra-powerful dashboard for your RevOps team.

Imagine ONE tool that improves forecasting, integrates data, gives you pipeline visibility, analyzes losses, and provides a real-time view of your markets.

Gong’s Revenue Intelligence Platform captures buyer and customer interactions across channels like email, calls, and web conferencing. It ties the data to opportunities in your CRM, then analyzes your data by team, pipeline stage, or opportunity.

No more guesswork.

Which deals will close this month? Is new messaging making it to the front lines? How are buyers responding to our new product launch?

Instant visibility into your team, deals and market.

Ohhhhh… That’s the talk track top performers use to close more competitive deals. This deal is in commit but pricing hasn’t been discussed. These customers are a churn-risk based on previous interactions.